Last week, I wrote about my dismal ability in predicting the short term market movements and allowing back end data to tell me where the market is going in the medium to long term.

By knowing this, you can then confidently take advantage of human fear and greed and buy when no one else dares to buy and position yourself for the long term.

However, that does not mean I don’t assess the probability of shorter term market pullbacks

Note here I talk about probability and not prediction because I cannot say for certain when a pullback will occur and to what magnitude. I just know with a higher probability that it is likely to happen and to position accordingly.

That is, to sell down any shorter term trading positions I have open and to lower my position sizing into any new investing or trading opportunities that become available.

So what am I looking at which gives me this confidence of an eminent short term pullback?

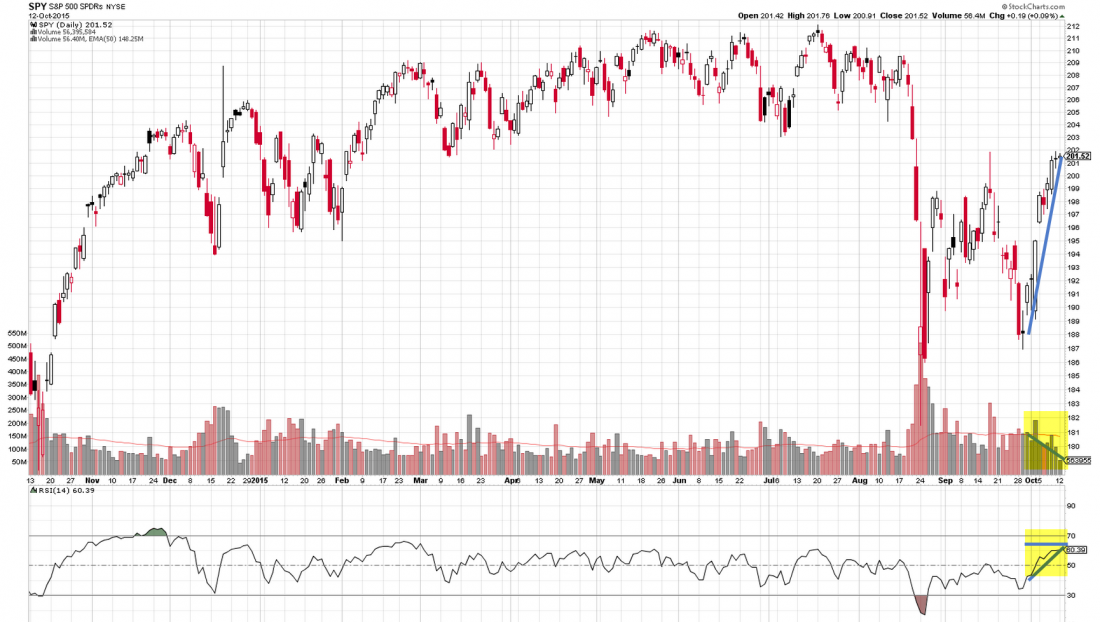

By simply looking at the following;

Why?

Notice the RSI indicator just ticking above 60, and diverging with the falling volume of the simple S&P500 ETF which suggests the lack of further shorter term market buying support in the broader market.

Finally combine this with over 64% of all stock prices of the S&P500 already over the 50 day moving average, suggests the market is due for this short term pullback.

History doesn’t repeat but it sure does rhyme.

The market has simply run too hard too fast in the short term.

So what actions will I take over the coming days?

I will continue to sell down any shorter term trades which have already run hard into profit and hedge out the long term investments held to eliminate any short term price movement risk.

This is what I classify as dynamic hedging at play.

Could I be wrong and is my view long term still bullish?

Yes. I can be wrong but there is a low probability of this. All I am doing is assessing daily probability and taking advantage to lock in short term profits and hedge out short term risk of my long term held investments. Back end data still suggest a strong bullish market in the long term.

These actions just smooths out short term portfolio volatility.