On Wednesday night, mobile payment processing company Square (SQ) is expected to price its 27.0 million share IPO within a range of $11-$13, equating to total gross proceeds of $324.0 million, based on the mid-point of the proposed price range. As followers of the IPO market are keenly aware, high-profile deals – particularly from the technology sector – have been few and far between over the past several months. There will be no shortage of hype surrounding this deal, though, and the scarcity of high growth tech IPOs should work in SQ’s favor. Of course, having tier one underwriters behind the IPO, including Goldman Sachs, Morgan Stanley, Barclays, and Deutsche Bank, certainly doesn’t hurt either.

From a fundamental perspective, SQ has a couple attractive attributes working in its favor, including strong revenue growth with plenty of runway for continued growth in its payment processing business. The valuation is difficult to ignore as well. More specifically, SQ’s P/S would be 3.3x annualized FY15 revenue, based on a pricing of $12/share. It seems apparent that the investment banks are pricing SQ conservatively due to the shaky IPO market, and the broader markets in general, in hopes of luring as many investors off the sidelines as possible. It also should be noted that with a float of just 27.0 million shares, the supply of stock isn’t overwhelming, creating a situation in which healthy demand could easily push shares higher.

At first blush, it may seem that SQ is a slam dunk, destined for a big opening day with shares closing well above its IPO price. And that may indeed be the case. However, from a longer-term investment point-of-view, there are several risks and concerns to be aware of. Even before discussing its financials, which have significant blemishes, there is the issue with its CEO. Namely, Jack Dorsey, who also recently has taken the reigns at Twitter (TWTR) as that company’s CEO, will be attempting to effectively run and manage two younger technology companies, each of which are facing their own set of challenges. That is a tall order. Should SQ struggle and its stock price dives, it’s easy to imagine the outcry from investors, demanding Dorsey to focus his attention on one of these companies, but not both.

The other primary risk is that SQ is a lower margin business competing against other technology behemoths and has not come close to turning an operating profit. In fact, its operating losses have been widening at an alarming rate and the company does not expect to be profitable any time soon. At the same time, SQ is raising more and more capital in order to finance new ventures, including “Square Capital”, which is fraught with its own set of risks. In short, SQ has a “part time” CEO, is attempting to shift its business model to include higher-margin opportunities, requiring a complete leap of faith from investors that the company will eventually succeed in that transition.

A Closer Look at Square

SQ’s core business is to provide businesses with simple, affordable, and efficient payment processing capabilities. It does this through its square-shaped hardware that attaches to mobile phones, and its square stand, which easily connects to tablets. SQ is typically associated with small and medium businesses, but, only 38% of its gross payment volume is generated through SMBs. In recent years, the company has had more success with larger companies, which speaks well to its reliability and reputation among the business community.

Its latest hardware can accept virtually every type of payment — credit cards, debit cards, Apple pay, Samsung pay, etc. Each time a credit card is swiped at one of its two million sellers, it earns a 2.75% transaction fee. The company states that its transaction gross profit is 110 basis points of GPV, sharply above most payment processors at 20-40 basis points. Overall, the fees generated from its Point-of-Sale hardware and services generate about 95% of total revenue (including Starbucks generated revenue).

On the topic of Starbucks, SQ entered into a payments processing agreement with the coffee chain in 3Q12, which was an unmitigated catastrophe for the company. In short, transaction costs, which include interchange fees set by payment card networks, bank settlement fees, and fees paid to third-party payment processors, exceed the transaction fees SQ generates. Since the agreement was inked, SQ has lost a staggering $71 million on the deal. This past August, the deal was modified to include higher transaction fees paid to SQ, but, the new deal also removed the exclusivity provision, allowing SBUX to transition to a new payment processor — which they plan on doing prior to the expiration of this agreement in 3Q16. For the nine months ended September 30, 2015, SBUX accounted for nearly 11% of total net revenue, so this is a substantial loss in terms of revenue. But, again, it really should be viewed as a net positive because it was a money-loser, and removes an overhang before the company goes public.

Striving to be More Than Just a Payment Processor

SBUX was an anomaly in terms of how badly it worked out for SQ. But, the payment processing business is still a thin margin business in general. Recognizing this, the company has been seeking ways to diversify its business into higher margin areas. So, in addition to the payments business, SQ has created a Software and Data segment which now accounts for 4% of total revenue, up from 1% a year ago. Included in this segment are Square Capital, Square Customer Engagement, and Caviar. Here’s a quick look at each of those businesses:

Square Capital: By far, it’s most important and intriguing component of the Software & Data segment, Square Capital provides cash advance loans to pre-qualified sellers. During the road show, management said that it has a 95% approval rate for these cash advances, which seemed very high. But, the risk loss has also been surprisingly low at 0.1% of GPV. Also, a majority of these advances are funded by third parties that commit to purchase the future receivables, allowing SQ to mitigate its balance sheet risk. Revenue is generated by SQ through a fixed percentage of a merchant’s daily processing volume being withheld as a repayment of the cash advance. To date, Square Capital has advanced $300 million with a 90% renewal rate.

Square Customer Engagement: This is a marketing service for merchants, providing them with easy-to-use tools that help to engage and communicate with customers. For instance, if a buyer opts to have a digital receipt sent to them, they can contact the seller about their experience directly from the receipt. From there, the seller can respond back directly, and offer customers a credit or refund, if they chose to. Customer lists are then built from those buyers who received digital receipts, which can then be organized (loyal, casual, lapsed) to add context.

Caviar: A food delivery service (very similar to GrubHub) that helps restaurants to reach new customers. Caviar can be accessed through its iOS and Android mobile apps, or through its website, with service available in markets such as New York, San Francisco, Los Angeles, and Philadelphia. SQ generates revenue through a fixed fee per delivery, plus service fee. It also charges its partner restaurants a service fee as a percentage of total food order value.

Financials

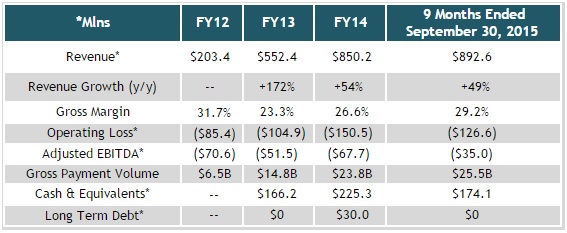

Revenue growth has been very strong, but, the rate of growth has been sliding considerably lower. For the nine months ended September 30, 2015, revenue increased 49% year/year to $892.6 million. In FY14, revenue jumped 54%, and in FY13, revenue surged 172%. A main reason for the slow-down in growth is that transactions generated at SBUX are slowing, as expected. Also, the company is simply lapping larger and larger numbers, so the growth rates are naturally going to come down.

A notable positive is that its gross margin is improving, albeit, margins are still pretty thin. For this nine month period, gross margin was 29.2%, compared to 26.6% last year and 23.3% in 2013. The improvement here is a function of two factors. First, the slower growth in SBUX-related revenue is also keeping SBUX-related transaction costs lower, which have been particularly damaging. The other factor is that its higher margin Software and Data segment has been growing faster than its payments segment.

So far in 2015, operating expenses in total increased 42% year/year to $387.6 million. Its largest expense, outside of transaction costs, is product development, accounting for 36% of total operating expenses. For the nine months ended September 30, 2015, product development costs were up 34% to $140.5 million. This was primarily due to the addition of engineering, design, and product personnel.

The company is not close to being profitable on an operating or net income basis. SQ is on pace to record a whopping operating loss of ($168.8) million versus ($150.5) million in FY14. There is some good news here, though. The company was actually cash flow positive for the first nine months this year, generating $2.9 million in cash compared to a cash burn of ($87.5) million a year ago.

Another positive is the balance sheet. As of September 30, 2015, its cash balance stood at $174.1 million, not including expected IPO proceeds. The company also doesn’t have any long term debt.

Conclusion

The first item to point out here is actually the valuation, not its recent growth rates or growth potential. At $11-$13 per share, a P/S of about 3x, and market cap of around $4 billion, the deal is being priced about as cautiously as possible. Yes, SQ has its issues, there is plenty of risk, including mounting losses, increasing competition, “management availability” concerns, but, this company is worth more than 3x this year’s revenue. Because of this cheap valuation, the upside potential and risk/reward look compelling.

I do have some serious concerns about the business, though. It’s unprofitable and is a low margin business, dependent on large increases in transaction volume to drive meaningful growth. Transaction costs eat up a lot of revenue, leaving very little to cover other operating expenses, let alone, fund any growth objectives. Mounting competition in the payments business is another concern. Since keeping transaction fees as low as possible is vital for any business, SQ could find itself competing on price against these huge competitors.

Wrapping up, the valuation on SQ is attractive enough here to strongly consider it. I don’t think a P/S of 4-5x annualized FY15 revenue is unreasonable for the company, which would value the stock at roughly $16.50, or 38% above the mid-point of the proposed price range. Because I feel the company has some significant fundamental flaws, I don’t feel a premium valuation is necessarily warranted at this point, though, so I would be leery of over-paying for it. To put it another way, if securing an allocation in the IPO is possible, I would strongly consider taking a stake due to the cheap valuation. Or, if an allocation is not possible and shares open with a reasonable premium to the IPO price, I would also consider taking a position as a shorter term play. But, I would be uncomfortable chasing SQ and paying a high multiple for it should the stock take off when it opens for trading. The current fundamental picture is too murky, in my opinion, to pay a rich premium and keep it as a core holding.