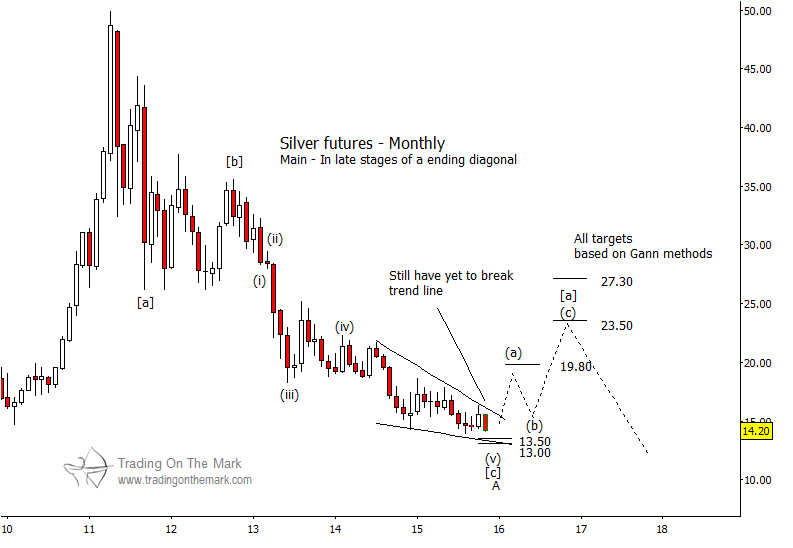

Silver futures have been testing a key Gann-related support area for almost a year while tracing a narrowing range. These conditions present a difficult scenario for traders working on what we consider to be the middle time frames – i.e., trying to catch moves that might last a few days or a couple of weeks. However, silver at its current level should present a relatively safe trade for those with a longer time horizon and modest expectations.

The declining, narrowing range on a monthly chart has the characteristics of an Elliott wave ending diagonal pattern, which is a terminal pattern. We are fairly confident that price will find support nearby, but timing the bounce out of a diagonal can be difficult. (Two of our earlier forecasts have called for the low to be in. Although the general support area has held, it has failed to ignite a rally… yet.) In coming weeks, price should stay mostly above the region of 13.00 to 13.50, although a brief poke beneath that area would not break the pattern.

The most important signal that the diagonal pattern has ended will be for price to move above the upper boundary. Longer-term traders might look for value buys before that event, but shorter-term traders probably should wait for that type of confirmation.

Looking ahead, we expect precious metals to form a corrective pattern for the next year and possibly longer. Price should stay within a range, with a generally upward bias but also with sizable reversals. The “road map” we have drawn on the monthly chart offers the simplest scenario for the next stage of the pattern. Price should test near the Gann target areas, but the levels should be considered approximate. We will refine the resistance targets with additional methods after price has put in a confirmed low.

The next edition of TOTM’s newsletter will examine charts for crude oil futures and the Dollar Index. Let us know if you would like us to send it to you.