It wasn’t much of a week in the stock market. The S&P500, the large-cap index, closed the week at 2090.11, less than a point above where it started. But at least it was better than Black Friday.

Black Friday, the day after the Thanksgiving holiday, is the busiest day of the year for US retailers, and it has become a harbinger of what they can expect for the holiday shopping season.

Since the holiday season accounts for about 20% of the year’s returns, everybody wants it to get started with a Black Friday shopping spree that will carry right through until Christmas. This year, despite the TV footage of people fighting to buy stuff, it didn’t happen.

Nation-wide, Black Friday sales were down by about 10%, or $1,200 million, from last year according to the Guardian newspaper. Online sales were up by about $150 million.

That follows a generally dismal year for US retail sales. Measured as an increase month-over-month, retail sales were down in winter, up modestly – less than 1% – in spring and summer, but essentially flat going into Black Friday. Nothing to make the bells ring there.

Black Friday also coincides more-or-less with the end of the Q3 earnings season, and all but 28 companies in the large-cap index have reported their results. They are not good either.

When all the returns are in, the companies in the S&P500 are expected to report Q3 earnings down 2.5% and sales down 4.0% year-over-year. Sales and earnings were down about the same amount in the second quarter too.

(Despite declining sales and profits, about 70% of companies managed to “beat estimates” for earnings; only 45% managed that feat for sales, which are harder to manipulate).

None of this is good news. About 70% of US GDP is derived from consumer spending, and the season between Thanksgiving and Christmas is the most important time. In 2015 it will be difficult for retailers to save their year by with a Christmas miracle.

And it may be equally difficult for companies with declining earnings and dropping sales to engineer a “Santa Claus” rally to pull the market up far enough to end 2015 with some kind of gain. At the close on Friday we were barely 30 points higher than the opening bell at the beginning of 2015.

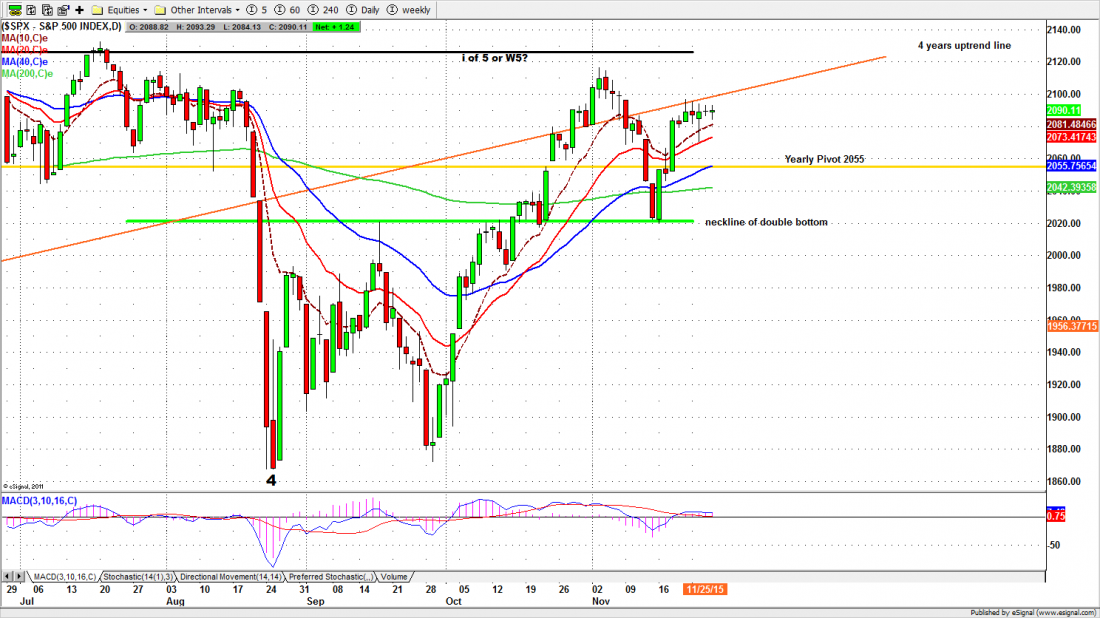

But there are year-end bonuses at stake, and December is the best month of the year for equities. The technical indicators point to a rally into the end of December, and – except for a couple of quickly reversed feints — the SPX has spent the past six days trading between 2095 and 2080.

Some kind of movement will take place this week, and it could easily be up. Fed Chair Janet Yellen is giving speeches on Wednesday and Thursday. Maybe that will be the spark that moves the market economy higher … no matter what the real economy is doing.

Today

Last week, with only three real days of trading, the S&P mini-futures (ESZ5) just marched in place. The futures closed Friday one tick higher than the open on Monday, despite a typical low-volume pump-and-dump move around the holiday. We may stay inside Friday’s range today, while we await the Word from the central bank.

Market sentiment continues to be bullish, and even last week buyers were happy to buy the dips. We expect that to continue this week.

If they push the price above 2098 expect it to move higher, perhaps up to the November high around 2110. If it can’t move higher, it may drop to the 2081 area. 2055 is the first major support.

Major support levels: 2055-56.50, 2033-31, 2001-03, 1995.50-92.25, 1975-72

Major resistance levels: 2103.75-07.50, 2114.50-16.50, 2123.50-25, 2134-35.50

For detailed market analysis from Naturus.com, free of charge, follow this link

http://www.naturus.com/mailing-list-signup-page/

Chart: SPX Daily chart to Nov. 27, 2015