We have many choices when buying a new tablet or smartphone including the technology of the display itself. This is becoming a more important decision as streaming media becomes ubiquitous. In regard to the display, there are two competing technologies: AMOLED (or Super AMOLED) and LCD.

AMOLED (Active Matrix Organic Light-Emitting Diode) technology is considered “next-generation.” Compared to conventional LCD screens, which have about 70% color reproduction accuracy, Super AMOLED screens reproduce colors that match nearly 90% of nature’s palette.

Moreover, these screens boast a contrast ratio that is 100 times higher and a refresh rate that is 1000 times faster than conventional LCD displays, resulting in a more visually captivating user experience. Overall, the picture quality of AMOLED screens used in tablets is about twice as good as an HDTV.

Interestingly, these screens are also more durable than LCDs (think unbreakable phones and tablets) and can be made curved and even flexible. All this comes in a super-thin package that uses up to 50% less power than LCD displays.

Although AMOLED displays have had some technical drawbacks and tend to cost more than their LED counterparts, as with most cutting edge technologies breakthroughs are an everyday occurrence. Recent improvements in manufacturing yields for large OLED screens will continue to exert downward pressure on prices.

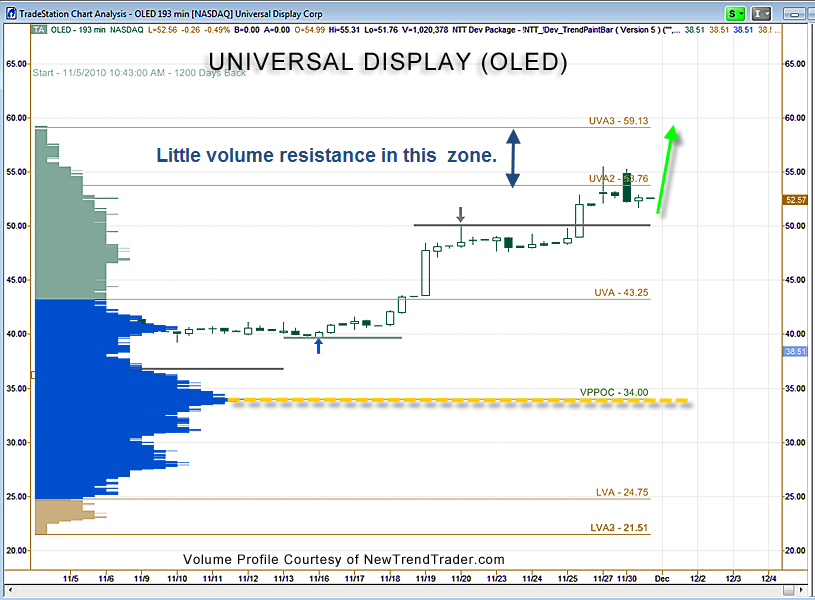

One way to play the AMOLED revolution is with Universal Display (OLED), a company that designs these advanced displays and licenses its patents. Universal Display owns, exclusively licenses, or has the sole right to sublicense approximately 3,500 patents issued and pending worldwide. Currently Samsung and LG are the two main players in this field and both pay royalties to Universal Display.

The company was in the news recently due to speculation that Apple will offer AMOLED screens in iPhones starting in 2018. To help meet growing demand for this premium product, LG Display is planning to spend $8.7 billion on a new OLED plant in South Korea.

The accompanying chart shows a Volume Profile distribution over the last 5 years that is classically symmetrical in its contours. While the stock is over-bought in the short-term, this profile indicates that there is little volume resistance above current prices. The initial target is the previous high of $59.13 and its blue sky above that.

www.daytradingpsychology.com (Assistance for private traders.)

www.trader-analytics.com (Peak performance consulting to RIAs, hedge funds and banks.)