Undeterred By Dormant IPO Market, Syndax Pharma (SNDX) Prepares to go Public

We’re now almost two months into 2016 and there have only been four IPOs to price so far. That puts us on pace for a whopping total of 24 IPOs for the full year, a ridiculously low total. Even in 2008, during the height of the financial crises, there were 31 IPOs to price.

Also of note is that the only IPOs to successfully launch this year have been pharmaceutical or biotechnology companies, continuing on a trend from last year when nearly half of all IPOs were from the healthcare sector. Therefore, it comes as no surprise that the lone IPO scheduled to price next week is a pharmaceutical company.

Like many recent pharmaceutical IPOs, this is a clinical stage company that has yet to launch a drug or generate any product-related revenue. That hasn’t necessarily been a barrier in the past in terms of how the IPO performs. For instance, Editas Medicine (EDIT), which went public on February 3, hasn’t generated any revenue yet, but, its IPO is up 26% versus its IPO price. So, while clinical stage companies are inherently riskier, and we have been operating in a risk-off environment for the most part, the lack of revenue doesn’t automatically translate into a busted IPO.

Still, the ice-cold climate for IPOs is a major hurdle, even for the most fundamentally-sound companies. A strong pricing and performance isn’t out of the question, but, the company is certainly swimming against the tide here.

Closer Look at SNDX & its Primary Drug Candidate

SNDX is a clinical stage biopharmaceutical company developing a drug candidate called entinostat as a combination therapy in multiple cancer indications. The company is looking to raise $66 million in gross proceeds by offering 4.4 million shares at $14-$16 each. The lead underwriters on the deal are Morgan Stanley and Citigroup.

As a clinical stage company, it has no products currently approved for commercial sale so it has not generated any product revenues. Consequently, SNDX has incurred losses in each year since its inception in 2005. However, as we discuss in more detail below, Entinostat is currently in a few different clinical trials and it has secured key development partnerships with large, global pharmaceutical companies.

Entinostat is an oral, small molecule drug that has direct effects on both cancer cells and immune regulatory cells, potentially enhancing the body’s immune response to tumors. The initial focus is on tumors that have shown sensitivity to immunotherapy, including lung cancer, melanoma, ovarian cancer, and triple negative breast cancer (TNBC).

The company believes entinostat’s safety profile and mechanism of action allow it to be readily combined with and enhance the activity of conventional cancer therapies, including checkpoint inhibitors, hormone therapies, and chemotherapies.

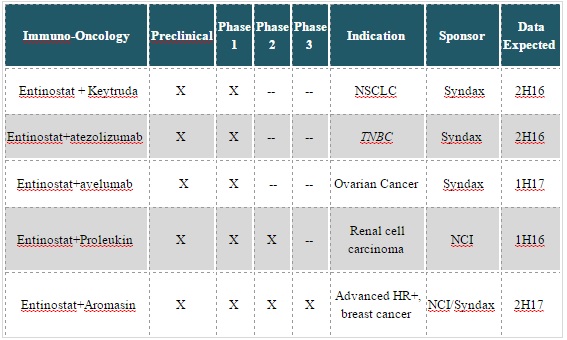

Current Clinical Trials

Entinostat is currently being studied in clinical trials across a range of solid tumors, including breast cancer, non-small cell lung cancer, renal cell carcinoma, and ovarian cancer. It is working with Merck to study the combination of entinostat with Merck’s immune checkpoint inhibitor, Keytruda, in a Phase 1b/2 clinical trial for up to 178 patients with NSCLC or melanoma. Patient enrollment for this trial began in August 2015, which will evaluate the safety and tolerability of the combination. The Phase 2 portion of the clinical trial will assess the efficacy of the combined drugs.

SNDX has also entered into a collaboration agreement with Genentech to evaluate the safety, tolerability, and preliminary efficacy of entinostat combined with Genentech’s investigational immune checkpoint inhibitor atezolizumab in a Phase 1b/2 trial (ENCORE 602) of patients with triple negative breast cancer.

Lastly, the company also has a collaboration with a subsidiary of Merck and Pfizer to evaluate the safety, tolerability, and preliminary efficacy of entinostat in combination with an investigational monoclonal antibody targeting PDL-1, called avelumab, which also is in Phase 1b/s trials (ENCORE 60). This trial is for patients with ovarian cancer.

Financials

With no product revenue to speak of yet, there isn’t too much to say about its financials at this point. For FY15, the company had a loss from operations of ($20.5) million, slightly less than FY14’s ($21.3) million.

As of December 31, 2015, the company had cash and equivalents of $146.3 million, on a pro forma basis, including IPO proceeds. The company expects to use the proceeds from the IPO to support its various clinical trials and to conduct activities to support the filing of a New Drug Application for entinostat.

Conclusion

Wrapping up, it is nearly impossible to gauge what the interest level will be next week for this IPO. The broader markets are whip-sawing around, the IPO market has been ice-cold, and trying to predict which pharmaceutical or biotech IPO will catch investors’ attention has been a guessing game. What we can say is, there are some qualities here that, under more normal conditions, would likely lead to a good pricing.

These attributes include the high quality underwriters, smaller float, the focus on cancer treatments, the fact it is involved in multiple indications, and the set of impressive collaborations. That said, for those brave enough willing to face the turbulence, and can stomach the volatility, we like SNDX’s potential. We just wouldn’t be overly aggressive given the current state of affairs.