Yesterday I speculated on the chances of a ‘surprise’ rally in the S&P 500. The analysis centered around the fact that the S&P futures had closed above a key resistance level (1920) on Wednesday.

The 1920 level is the Volume Profile Point of Control over the last 60 trading days and on Wednesday it became important technical support.

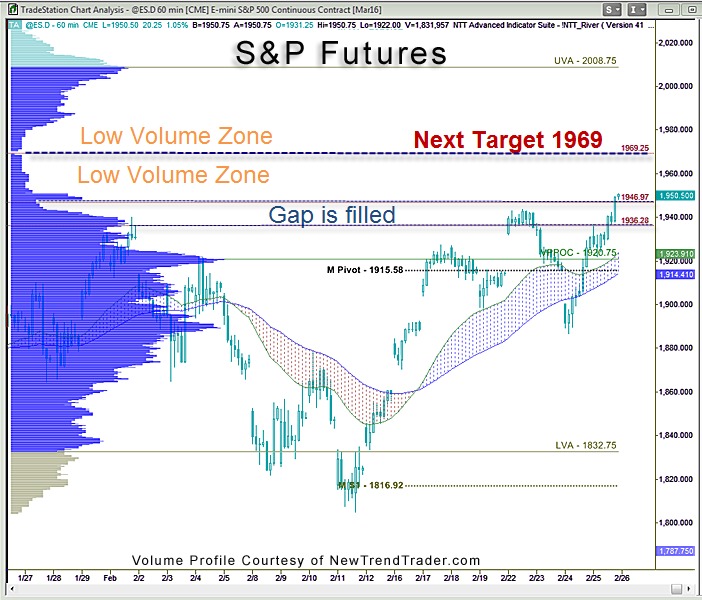

I also pointed out the volume gap between 1936 and 1946, which was decisively ‘filled’ on Thursday. That leaves us with the low-volume zone between 1946 and 2008 (orange labels on the accompanying chart.) I call such low volume zones “speed zones” because markets tend to move very quickly through them… in both directions.

Since the S&P futures have filled the gap zone, we have the potential for a significant short-covering rally. The next target is 1969 marked in red and it won’t necessarily require a news catalyst to get there. After that, if there is still fuel in the tank, we are looking at a final target of 2008.