Hey lovely folks out in the trading world! I hope you’re doing grand!

It’s that time again! Another week, another month and earnings season approaches. I want to provide some free education today on ratio spreads and how to use them in real life.

First, let’s just be clear: there are almost countless forms for ratio spreads. The main definition and most logical explanation of ratio spreads is this: When a trader has two option orders open and one has strike has a different quantity of contracts.

Ratio spreads can be debit spreads or credit spreads. Some might require margin, others won’t.

The ratio spread I prefer the most is the ratio debit spread. This is when you have x number of long options and x-y number of short options.

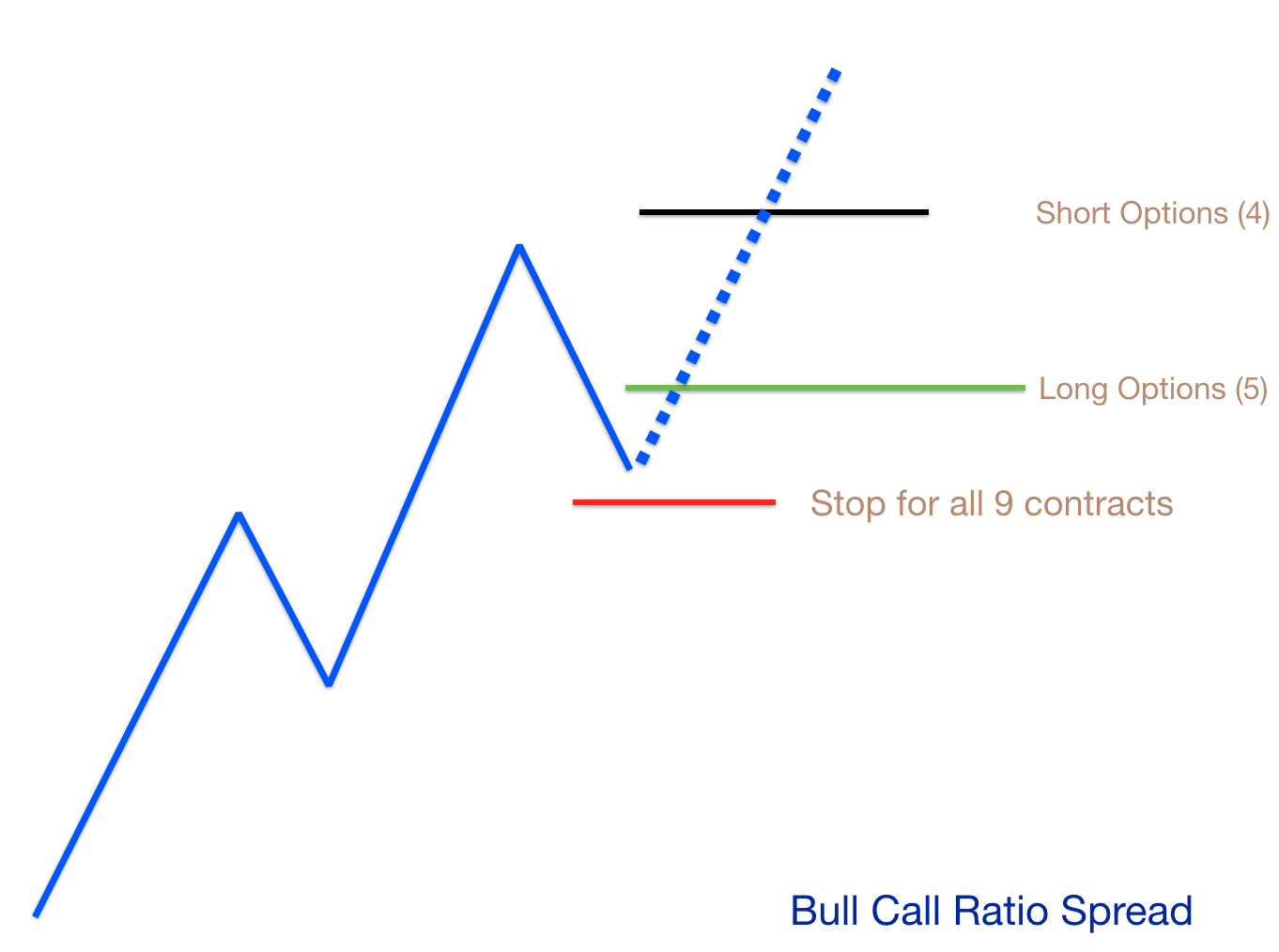

Example: You are bullish on TSLA. You buy 5 $245 May calls spending $13.50 per contract. Total cost initially is $6,750.

You then sell 4 $265 May calls at $6.95 a piece. This brings in $3,475 of premium.

Your Max gain on 4 of your options is $265 – $245 – $20.00.

Your Risk on the 4 options is $6.55

So R:R on the 4 options is 6.55/20 which is solid. Better than a 1:3.

You still have that 5th option though. The reward on that option is not capped. TSLA could go into $300 and you still have that call option. The risk on the option is, of course, the $13.50, which is what you’re paying for it. As I’m sure you know, you can place a stop on that position to mitigate losses.

This specific strategy would be known as a Bull Call Ratio Spread. You could do a Bull Call Ratio Calendar Spread, too, if you sold the 4 calls at a different expiration date, say, April week 3. The premium you would be receiving would obviously be much less.

Some traders call that 5th contract in the above example “the lottery ticket” in case the trade really does run strongly in your favor. The overall trade would cost money to get into, but it costs significantly less than just buying the five call options by themselves. It is a limited risk, kind of limited return strategy, but that extra option is always fun to have, just in case. Below is visually, how I interpret this specific strategy.

If you are looking for a more basic explanation of options, feel free to watch this YouTube video