SHORT-TERM (today and 5 days out)

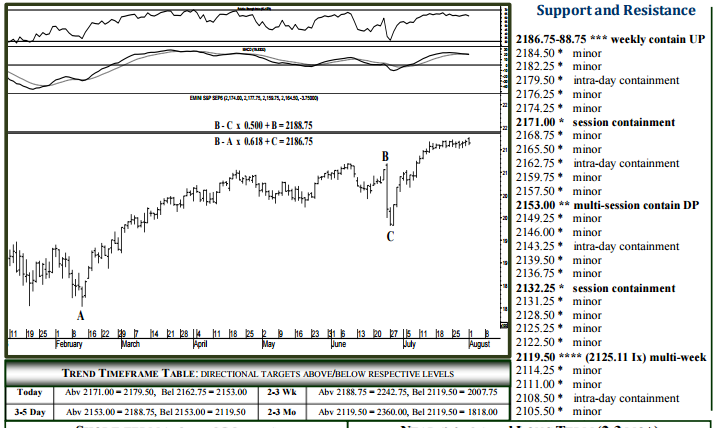

For Tuesday, 2171.00 can contain session strength, 2162.75 in reach and able to contain initial selling, below which 2153.00 becomes an intraday target able to contain selling into later week. Holding above 2153.00 should yield 2186.75-88.75 by Friday’s close, while a settlement today below 2153.00 indicates a good weekly high, long-term support at 2119.50 then considered a 3-5 day target able to contain selling through August activity and above which 2242.75 remains a 3-5 week target. Upside Tuesday, pushing/opening above 2171.00 indicates 2179.50, likely to contain initial strength and beyond which 2186.75-88.75 becomes intraday objective able to contain weekly buying pressures. A settlement today above 2188.75 maintains a bullish dynamic into later August, the targeted 2242.75 formation then expected within 2-3 weeks (page 2).

NEAR (2-3 wks) and LONG TERM (2-3 MO+)

The 2119.50 region (2125.14 Index – page 2) can absorb selling into later year, above which 2242.75 remains a 3-5 week target, 2360.00 attainable by the end of the year. Upside, 2188.75 can contain weekly buying pressures, with a settlement above likely to yield the targeted 2242.75 formation within several weeks, likely to contain monthly buying pressures when tested. A settlement above 2242.75 maintains an accelerated upside pace into Q4, 2360.00 then expected over the following 5-8 weeks where the market can top out well into 2017. Downside, a daily settlement back below 2119.50 would be considered a failed long-term buy signal, essentially a valid sell signal into later August, 2007.75 then considered a 2-3 week target able to contain selling through September and a meaningful downside tipping point into early Q4.

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE