Although I am never one to like commenting about market direction since I get it right as much as I get it wrong in the shorter term, there are times when I do warn my viewers when I see warning signs of a potential market pull back.

This is one of those times. Could I be wrong? Yes.

But the probability is stacked in our favour, and investing and trading really is all about probabilities, and investing with it on your side.

One must never forget that the market drives over 75% of all stock price movements, and the best returns are for those patient enough to wait and then move against the crowd.

That is, to be greedy when others are fearful and fearful when others are greedy. And current market conditions call for the latter.

So what do I see? Let’s get straight to the point.

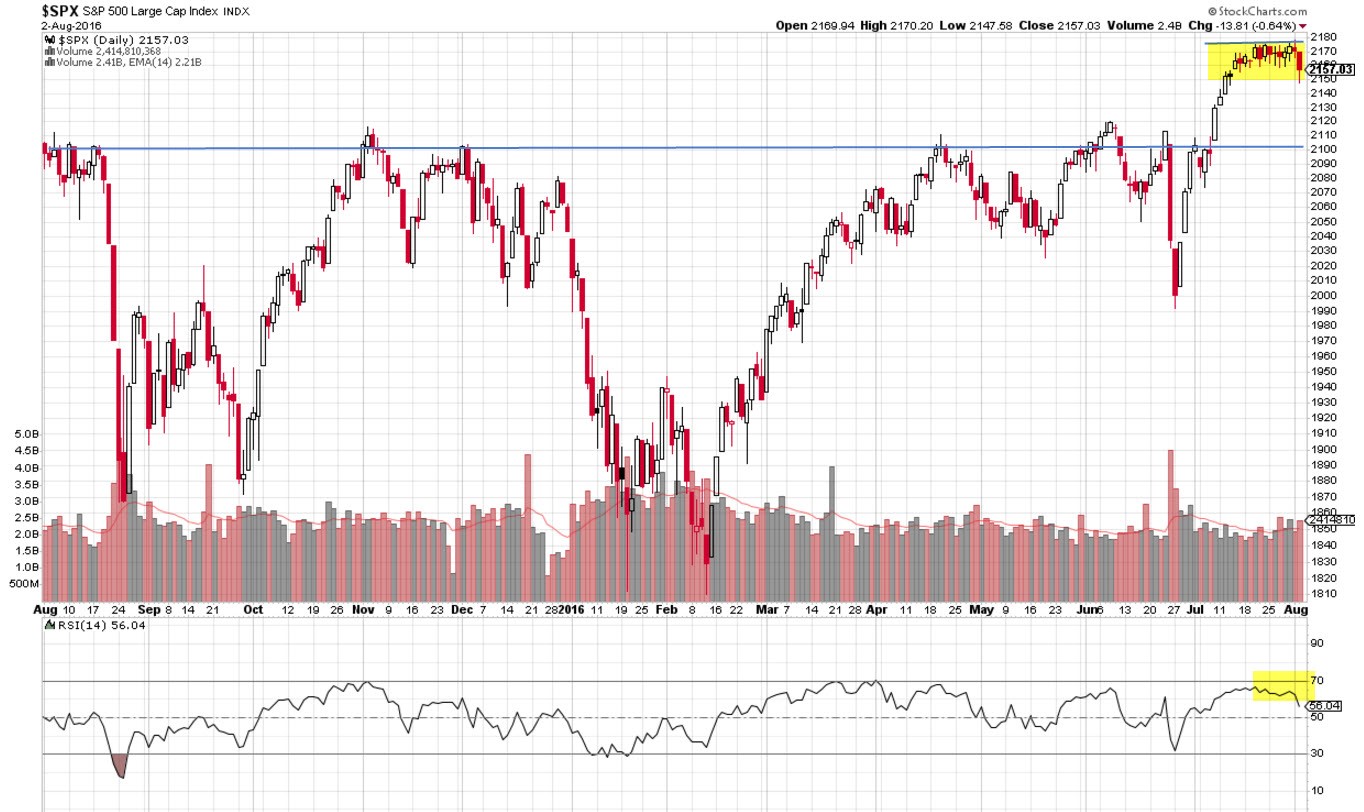

The S&P500 index finally after a whole year, broke through its long time resistance of 2100 in early July and pushed forward another 3% with earnings season kicking off and most companies (especially the technology sector with the likes of Facebook, Microsoft and Google) wildly exceeding analyst expectations.

However, for the past fortnight I have been warning both my investors as well as students to begin locking in shorter term trading profits as the market enters what I call ‘high market risk’, and further capital gains will be hard to come by for both longer term investments and shorter term trades.

The index has literally been consolidating around a new resistance level of 2170 while numerous momentum indicators like the RSI are in over-bought territory.

Over the past month since the Brexit reversal, which by the way was the best time to take advantage of bargains, there has been a lack of long term investment opportunities where one can invest with a ‘margin of safety’ when individual stock prices are below their intrinsic value.

During times when there is a lack of long term investments, it usually also means the market as a whole is temporarily overvalued and there is also significant risk putting on shorter term long trades due to a high probability of a significant market pullback.

We must never forget that we as investors and traders have one job only, and it is not about having excitement in the markets. Our job is to send our capital out to work, and then bring it back hopefully with a profit when times are no longer favourable.

Patience, temperament and a willingness to go against the crowd is therefore key to winning this investment and trading game in the long term.

To find out how you can safely learn to trade and invest in 10 simple steps, click here