This week’s collection of oddities

Nothing really exciting happened in the markets this week. But there was a collection of small things – none very significant to the markets in themselves – that might add up to something bigger. Or maybe not.

- An odd triple top. Last Thursday the Dow, the NASDAQ and the S&P all made new all-time closing highs. All three passed record highs they set earlier this month. The major indices have not made simultaneous new highs since the start of this millennium – Dec. 31, 1999 to be precise.

There is something disturbing about seeing all the markets marching in lockstep like this; they are all obviously dancing to the same tune, but it not clear who is writing the music. The gains are attributed to good jobs data (suspicious) and higher oil prices.

But the jobless numbers, if not revised away, are dicey (the increased jobs are mainly a function of “seasonal adjustments” in the data) and there are few other signs of life to lift the markets. Corporate earnings, in general, are abysmal, and the volume on these all-time highs is substantially below average.

So what is floating this balloon? And how long will it stay aloft?

- Hillary and Bill Clinton released their 2015 tax returns. As was widely repeated, their family income was about $10 million for the year, and they paid 34% in taxes, a result that sounds carefully calculated to be politically acceptable: a down-page item in a political news cycle dominated by the latest Trump “outrage.”

But what was known but not widely reported was infinitely more interesting.

The Clinton family tax return for 2014 shows about $28 million in income; the 2013 return was about $27 million. Since they left the White House at the beginning of 2001 — when Hillary said they were “dead broke” and worried about paying for Chelsea’s education — the family has earned about little less than $340 million.

What did they do to make that kind of dough? Mainly, they gave speeches. In 39 weeks after she resigned as Secretary of State in January 2013, Hillary earned $9.7 million in speech fees, at about $225,000 a pop. In the 24 months after her resignation her speaking income totalled $21.4 million.

Those are eye-popping numbers. One can only wonder what she could tell the American Camping Association that was worth $260,000, or why Let’s Talk Entertainment Inc. in Toronto would give her $250,000 for a half-hour speech. And Goldman Sachs, let us not forget, gave her $675,000 for three (and another $1.35 million to her husband).

But what is even more wonderful, in this election year, is that none of this is a topic of discussion.

- Chicago, again. A couple of weeks ago we mentioned the pension woes plaguing Chicago, as well as other cities. This week there is something worse.

As the the Chicago Tribune reported, for the past week 110 people were shot in various incidents in Chicago; 24 people were killed. It was the worst week for gun violence since 2013. So far this year 2621 people have been shot, about 50% more than this time last year, and there have been 445 deaths. At the current rate the number of murders this year is likely to exceed 700.

This is a sad story, and we’re not repeating it to pick on Chicago. This is symptomatic of what is happening all over America, in cities everywhere.

Somehow, in this election year, this isn’t a topic of discussion either.

Last week

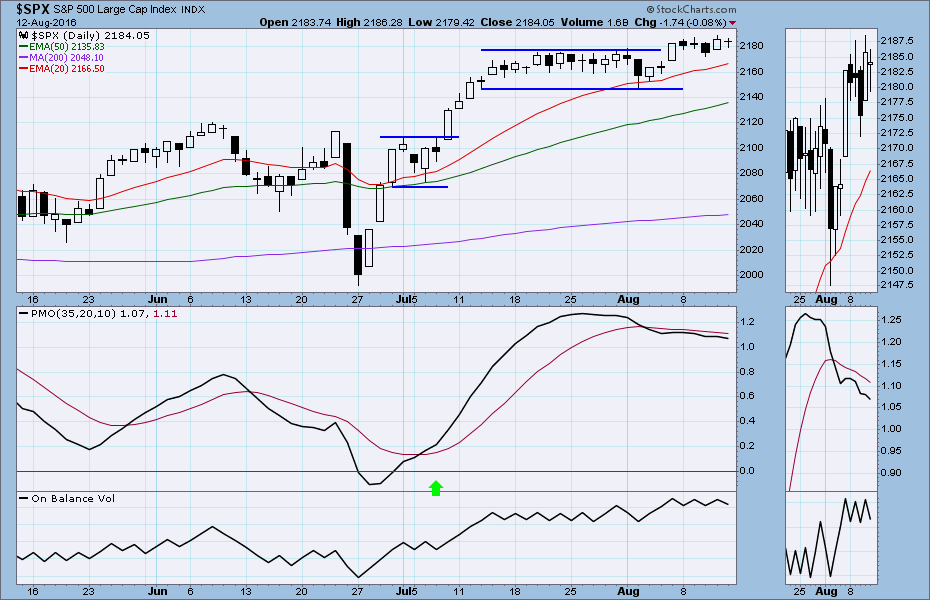

The S&P 500 cash index ($SPX) closed at 2184.05 last Friday, up 1.18 points for a tiny weekly gain.

SP500 index had the narrowest range week since Sept 2014. The lack of momentum for an upside move should make traders cautious in the coming weeks.

The SP500 index has almost completed a three-push move up. The rally from the June low is close to the ending stage. Given the ultra-short-term overbought condition, it is due for a pullback.

This week

Lots of economic activity this week and a slew of option expirations that may whip the market around a little.

The August major stock index option expirations on Wednesday, Thursday and Friday could move the index in either direction. And we have the Empire State index, with a big increase predicted, Consumer Prices and Core CPI, Housing Starts, the ever-popular FOMC minutes Wednesday, and Weekly Jobless Claims on Thursday. A fairly busy week.

Market sentiment remains bullish, but it is overbought, and we may be due for a pullback. The August low around 2150-45 zone could be the pullback target.

However before that happens we could also see a final push up to move the index up to the 2200 area or a little higher towards the full measurement from the breakout at 2230.42. But there isn’t much room to the upside. It could happen, but it would be a surprise.

Today

The S&P500 mini-futures (ES) managed to hold above 2175 to prevent filling the 2172.75 gap last Friday. The slow momentum and a continuation of last week’s grinding move could lead to profit taking in today’s early session and fill that gap.

2190-2200 will be the upside major target this week.

For the downside, holding above the 2165-70 zone will be very important; a move below 2162.50 could trigger an ultra-short-term pullback.

We have a short-term overbought condition that may precipitate that pullback; if there is a retracement we would not be surprised to see it reach the early August low at 2147-50.

Major support levels: 2155-56.50, 2146-43.50, 2133-28.50, 2103.50-00.75

Major resistance levels: 2188-87, 2196-93, 2103.50-06.50, 2214.50-12

Visit www.naturus.com for more weekly analysis of gold, oil and the S&P. It’s free.

Chart: SPX Aug. 12, 2016. Daily chart