The world of ETF’s can be great for the retail investor. Sometimes it gives the impression that a smaller investor can get in a market that typically prices them out of the market. For example, Crude oil. It used to be that in order to trade Crude Oil, you had to trade Crude Oil Futures. That meant that you had to set up a futures margin account. From Zacks:

Most futures are traded through brokerage margin accounts. Margin is the cash deposit a trader must post for each contract held. Margin requirements usually range between 2 and 10 percent of contract value, depending on the exchange, contract type and expiration date. NYMEX requires initial margin of $6,210 per contract for crude oil futures expiring within one year and less for later expirations. Margin must be maintained throughout the life of the contract; maintenance margin on the NYMEX contract is $3,600. If the cash in a margin account falls below the maintenance level, the exchange will issue a margin call. If the trader doesn’t replenish the account by the next day, the exchange will terminate the trader’s contracts.

You can see how this might become problematic for the smaller trader. Enter the ETF worth specifically with the ETF USO. USO is very liquid, can be traded in any account where you can trade equity options and typically offer narrow bid/ask spreads. But they can pose their own problems as well.

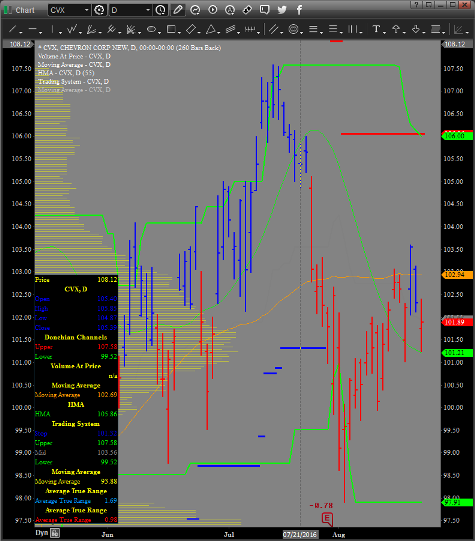

Let say that you want to trade Crude Oil and don’t have a futures account. You can trade USO right? Certainly! The issue that comes up is that USO is currently trading around $11.00. So, let’s say that Crude Oil moves 3% as it has done more than a few times over the past few months. That translates into a $0.33 move in USO. That is not even through one strike. So, because of the low underlying value of the underlying, this translates into fewer opportunities using options on USO. So, are we just out of luck? Not really. All you have to do is find a proxy for Crude Oil that trades significantly higher than USO. Take a look at Chevron (CVX). The annual return for CVX has a correlation coefficient with USO of 0.90. That’s a nice proxy! Given the chart structure of oil, we are willing to take a bearish play. Upon looking at CVX, it is no surprise that it is setting up on one of our favorite triggers the inside bar. Take a look at the chart:

If we get our trigger price at $101.09 we want to put out the following signal:

Buy (opening) the CVX September Expiration 100 strike put

Sell (opening) the CVX September Expiration 98.5 strike put

For a maximum debit of $0.35 or lower.

The signal is not GTC and is valid with CVX trading $101.00 or lower.

If we can max out this spread, it will afford us a reward to risk ratio of 3.29:1 with a maximum risk of $35.00 per contract purchased.