Following last week’s post about corn futures, we continue our focus on grains by highlighting a support area to watch in wheat futures. Although there is not yet enough evidence for us to conclude that wheat has made a durable low this month, we believe there is the potential for a bounce or a larger rally to start. At the very least, traders should be cautious with any existing short positions.

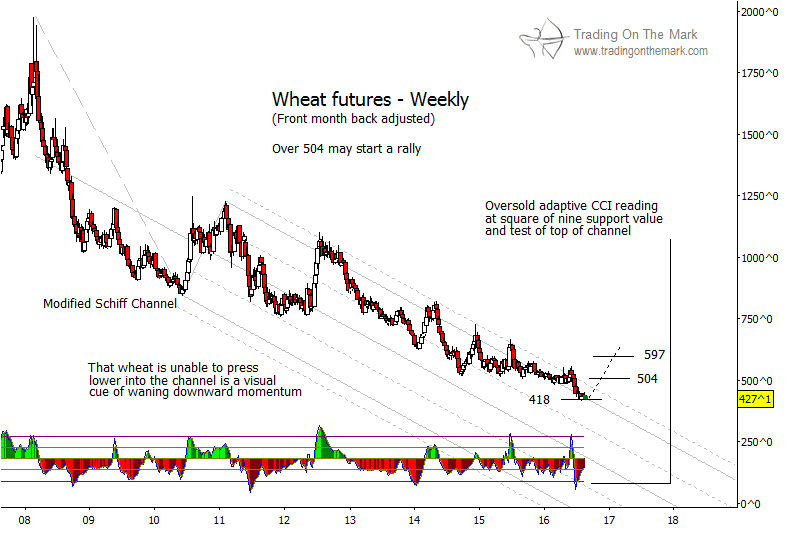

Wheat has declined since 2010 while giving some recognition to the boundaries and harmonics of the modified Schiff channel we have drawn on the weekly chart below. However, the recent test of a Gann square-of-nine level near 418 coincides tests of support in other grain markets. A rally from the present area would represent an attempt to break upward out of the channel and could possibly change the trend.

If price achieves a weekly close above another square-of-nine level at 504, then the next similar level at 597 becomes a likely target. On the other hand, a weekly close beneath 418 would suggest that the downward trend might not be quite finished. The Elliott wave pattern is not clear for wheat, so we cannot rule out the possibility of another small upward and downward swing.

Our next email bulletin will focus on this and other tradable grain products and will explore possible timing for the expected rallies. Request your copy via this link.