The Institute for Supply Management’s index fell by 3.2 points to 49.4 in August, the biggest drop in more than two years and signaling contraction for the first time in six months, the Tempe, Arizona-based group’s report showed Thursday. Readings above 50 indicate growth, and 11 of 18 industries surveyed by the purchasing managers’ group indicated weakening.

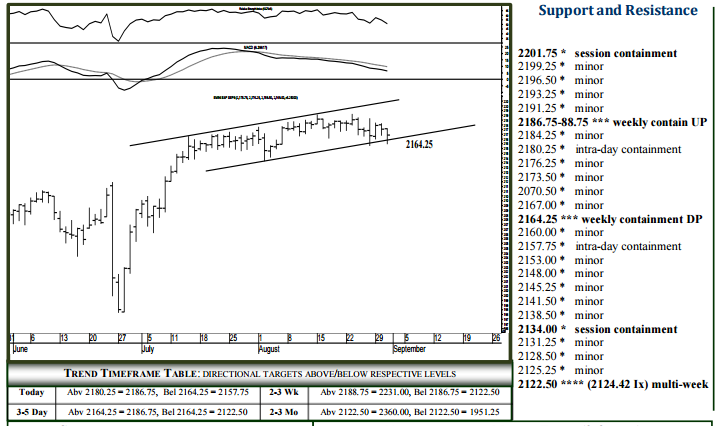

The market is lower today but here’s the technicals to look at going forward for the E-mini.

SHORT-TERM (today and 5 days out)

For Thursday, 2164.25 can contain weekly selling pressures, above which 2186.75- 88.75 remains a 2-3 day target. Upside today, 2180.25 can contain initial strength, while pushing/opening above 2180.25 indicates 2186.75-88.75 intraday, able to contain weekly buying pressures. A settlement today above 2188.75 sustains a bullish dynamic into later September, 2201.75 then expected within several days, 2231.00 within several weeks. Downside Thursday, breaking/opening below 2164.25 signals 2157.75, while closing today below 2164.25 indicates a good weekly high, the 2122.50 formation (page 2) then considered a 3-5 day target able to contain selling not only through September, but also the balance of the year

To receive a two week free trial of the Daily Futures Letters and Monthly Futures Wrap, CLICK HERE