When we wrote about copper futures in May, we suggested that price was forming a small fourth-wave bounce that would be followed by a resumption of the larger downward trend. Our forecast remains the same, with some very small changes in support targets. However price action during the last four months has presented a way to define and limit the risk of an upward move for anyone thinking of trading short.

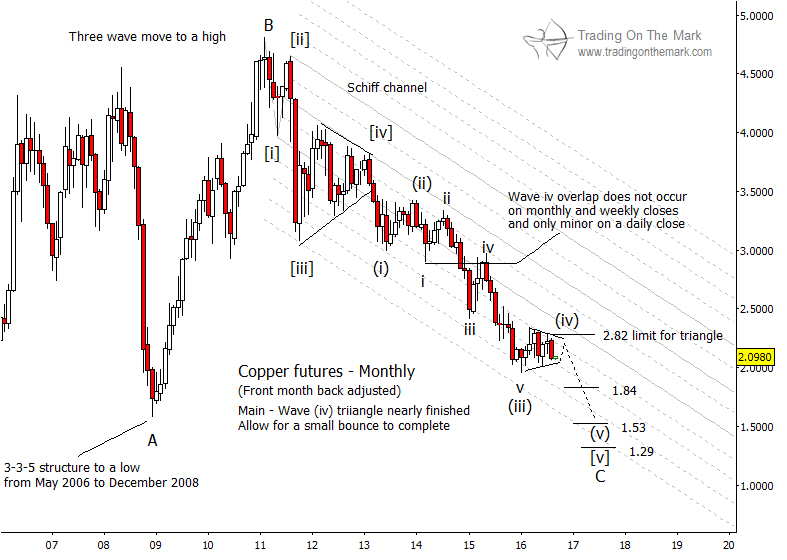

In Elliott wave parlance, second waves and fourth waves are corrective moves inside a larger motive wave that consists of five segments. In the case of copper, we believe price is proceeding through a five-wave count downward that began in February 2013, when price broke downward out of another fourth-wave triangle on a larger scale. The downward count we are currently following is labeled on the chart below as (i)-(ii)-(iii)-(iv)-(v).

In a five-segment motive wave, the two corrective sub-waves typically trace patterns that are different from each other. However in a motive wave, only wave (iv) can take the form of a triangle. That appears to have happened during the summer as copper prices have moved mostly sideways.

For the triangle pattern to be valid in copper, the next upward leg of the triangle should be constrained to extend no higher than the previous small move. In other words, a triangle pattern would predict that price should climb no higher than approximately 2.82, and then it should fall.

On the other hand, if price ventures above 2.82, that would signal that the fourth-wave correction needs more time to complete. In that case, traders who are still thinking of a short should wait for price to test higher resistance levels.

Follow on Twitter and facebook to get timely market updates from Trading On The Mark!