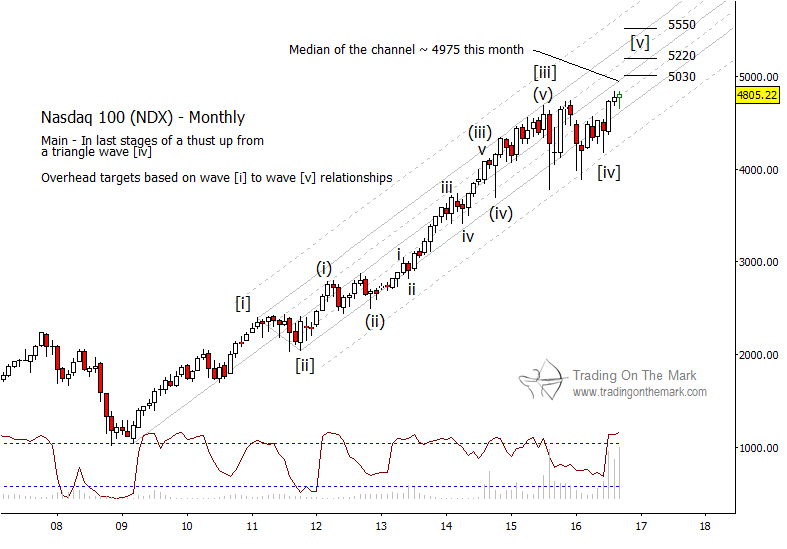

The NASDAQ 100 Index (symbol NDX) is poking above the range that has kept it constrained for more than a year, but the upward move might not be long-lived. The rangebound consolidation had many of the characteristics we associate with a corrective fourth wave, which suggests that the move out of the range will be the last one in the upward trend.

From an Elliott wave perspective, when a consolidation occurs after a trending move has begun to appear “mature,” it becomes a candidate for being a fourth wave correction. Typically, the correction will test the outer boundary of a guiding channel on the chart, or sometimes an outside harmonic of the channel as NDX has done repeatedly.

The NDX consolidation also counts well as a five-segment triangle, which is a common form for fourth wave corrections to take.

With the recent new high, the pattern in NDX technically could be considered complete on a monthly time frame. Even so, we think traders need to allow for the probability that the index will continue upward to test near the center line of the channel – currently near 4975 – or slightly higher into Fibonacci resistance at 5030. A test of higher Fibonacci levels at 5220 or 5550 is possible but less likely.

As we move into autumn, note that the Lomb periodogram (the maroon indicator at the bottom of the chart) has reached the top of its range. In times of normal market volatility, the Lomb cycle is often a good predictor of small or large reversals.