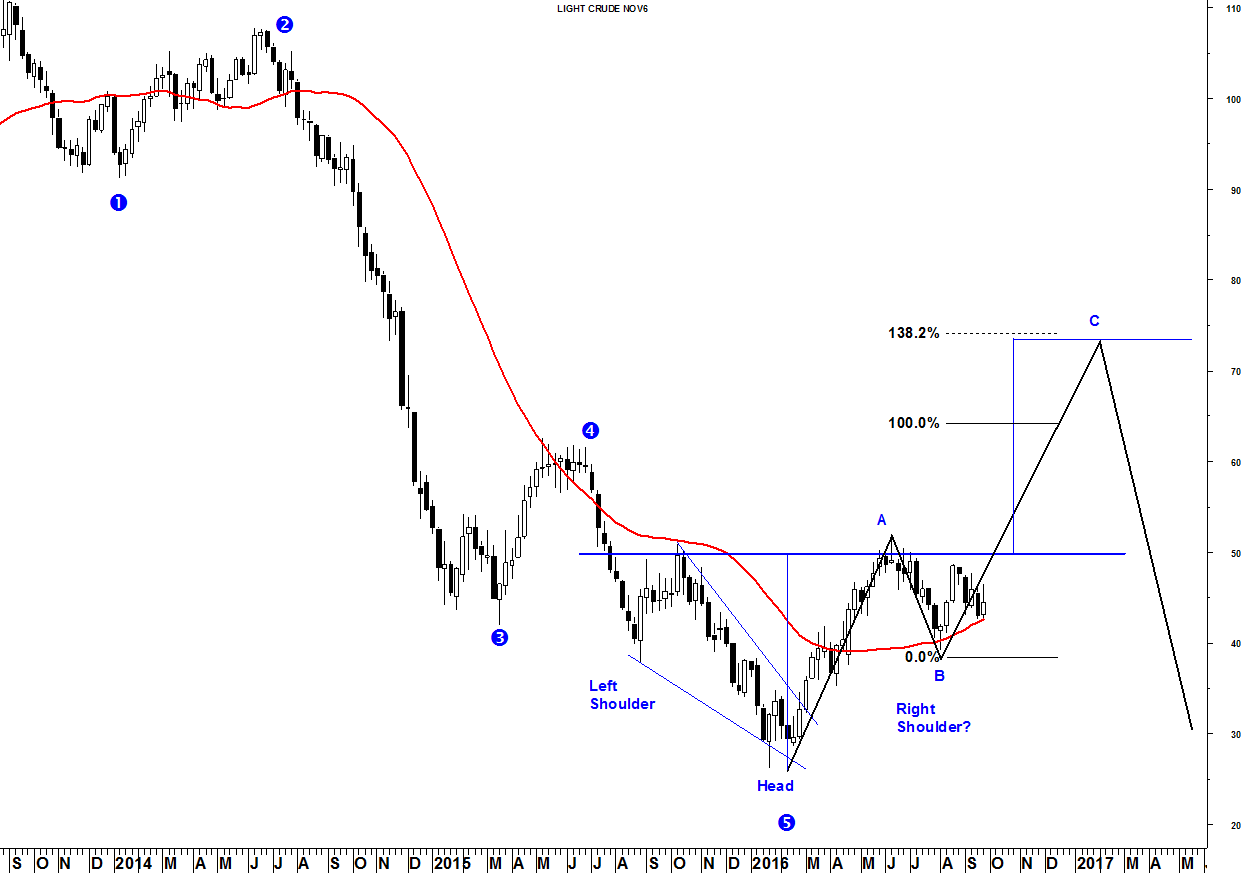

Crude gained $1.45/bbl. last week closing at 44.48 even after a $1.84 loss on Friday. Since the August high, crude looks like a descending triangle (bearish). The upper trendline passes through 46.75 this week. Support is at 43.25. A break of support opens the door for a decline to 38.25. The weekly Coppock Curve did confirm the June high so look for higher highs in the future. However, new lows are expected once wave C has completed.

The August 3 low may be the right shoulder of a bullish head-and-shoulders pattern. If triggered by a close above the neckline at 50.00, it measures a minimum rally to 74.00.

Try a sneak-peek at Seattle Technical Advisors.com