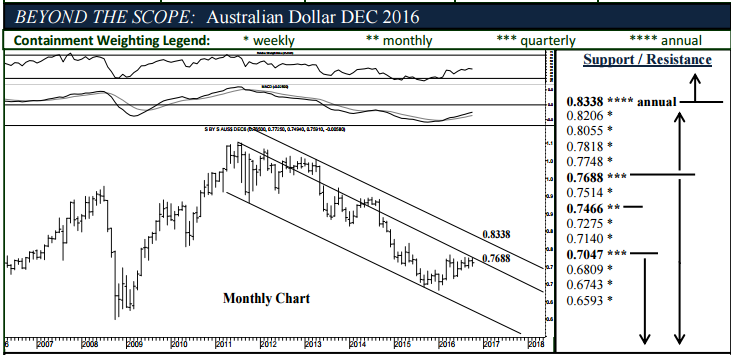

The Australian Dollar encounters overhead resistance this month at 0.7688 able to absorb buying through the balance of the year, below which 0.7047 remains a 3-5 month target. Downside, 0.7466 can absorb November selling pressures – above which 0.7688 remains in close reach for the month. A November settlement below 0.7466 signals 0.7047 by the end of December where the market should bottom out through Q1. A monthly settlement below 0.7047 maintains a heavy dynamic well into 2017, the 2008, 0.5975 low then susceptible for retesting over the following 5-8 months. Upside, an end-of-November settlement above 0.7688 maintains a recovery dynamic into early 2017, the 0.8338, five year channel-top then considered a 3-5 month target able to contain buying through 2017 and below which the Aussie currency remains locked in a lo3-5 year bear market. While highly unlikely, a November settlement above the 0.8338 formation maintains a constructive dynamic well into 2017, 0.9402 then expected over the following 5-8 months.