Pre-election jitters have taken their toll on the equity markets. The Russell 2000 has fallen 8%, just over 100 points or, $10,000 per futures contract since October 10th. This week, we’ll show the different behaviors exhibited by the three most important groups in the Commitments of Traders report, why the little guy usually loses, and what this probably means for the stock market through the election.

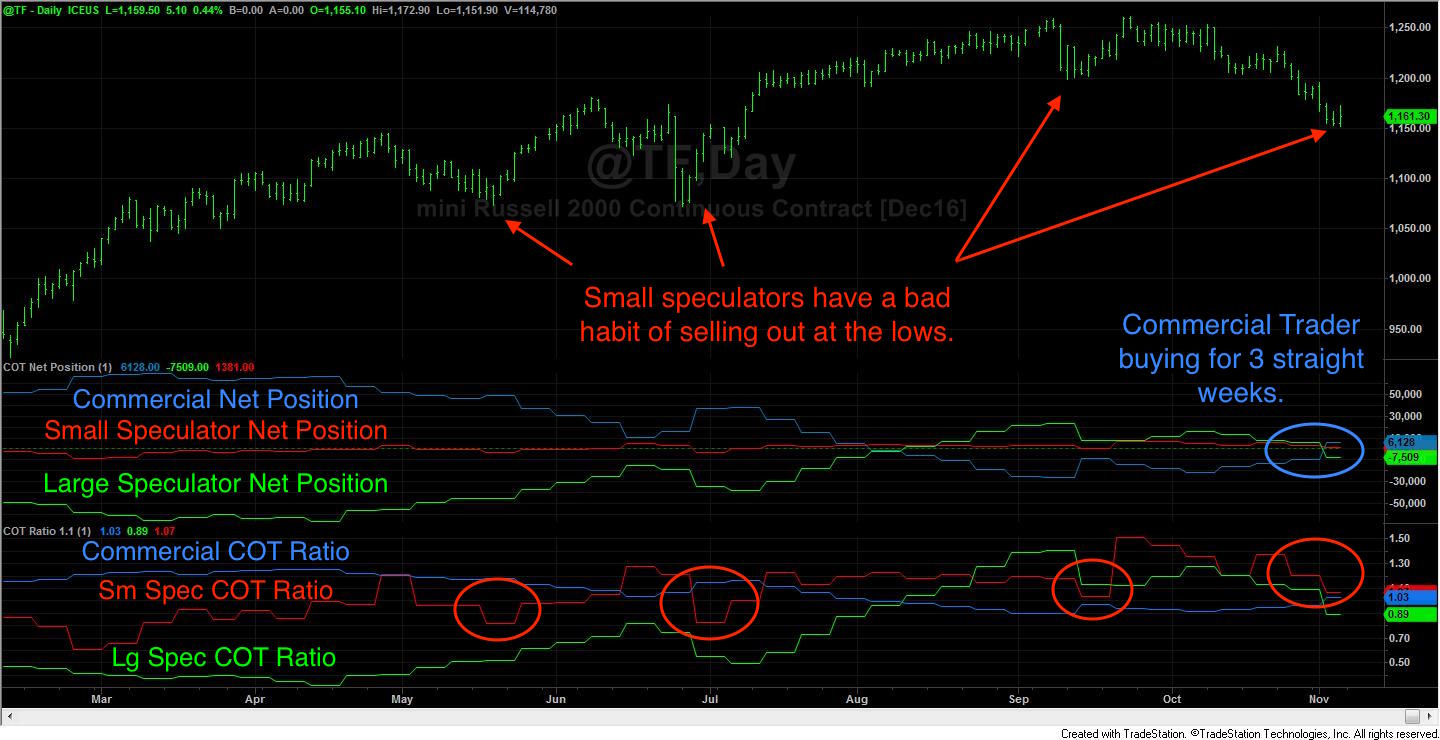

We use the Commitments of Traders report to track the net and total positions of the large and small speculators as well as the commercial traders. We combine this data to produce our COT Ratio indicator in the bottom pane of the included chart. Before addressing the current situation, let’s look at the behavior of the large speculators and commercial traders. Large speculators are trend followers. Notice how their position builds from mid-April through mid-June and then shrinks dramatically on the late June plunge. This is the effect of offsetting the long positions that had been built up over months in the span of a couple of days. Once again, large speculators form a long position from mid-July through mid-September and are forced out quickly as the market sold off sharply.

Now, compare this to the behavior of the commercial traders. Commercial traders are negative feedback traders. This is the opposite of the large speculators’ trend following approach. Commercial traders buy more as the market declines and sell more as the market rallies. Note the surge in commercial buying on the July decline. Also, note that the commercial traders reached their most short position on the chart just ahead of the September sell-off. Finally, regarding the current situation, commercial traders are not only buying but the pace of their purchases increased on last week’s decline.

This sets the stage for the current situation. The worst insult to a trader is being, “faded.” A fade occurs when a trader is on a terrible cold streak, and the best money to be made is taking the opposite side of their recommendations. This is exactly the situation with the small speculator trading group. It has been said that 90% of people who try trading futures are losers. Well, this is the pool from which the vast majority of the 90% come. For every headline trading firm flameout, there are a thousand anonymous people who try and fail or, quit. The small speculator category is a perpetually rotating class of rookies who are prone to making rookie mistakes. Note that the small speculators have their largest positions on at the most inopportune moments. They are exactly wrong. Now, they’ve been selling for three straight weeks as they finally appear to have given up on their most bullish position established in mid-September…at the market’s high.

The odds are that their selling probably gets us pretty close to a bottom. When we combine the small speculators’ poor track record with the commercial traders’ success, the odds of a near-term bottom forming become even greater. Therefore, we’ll be looking for buying opportunities in the stock index futures heading into this week. Once triggered, we’ll publish the entry signal and protective stop in our nightly Discretionary Cot Signals email. Sign up for a 30-day free trial, and you can be alerted when this trade triggers.