With the New Year finally here and the market touching market highs, I thought I’d share my thoughts of where I believe we are headed and if we should sell.

If you have followed my writings over the years, you will notice that I’m never one to predict the markets, as I can never say to you precisely what level the market will be at in say one or two weeks’ time. Honestly I have no idea.

But what I do know is that by using simple tools to gauge the market, we can all easily see if there is either too much greed or too much fear in the markets. At this point in time, it is definitely the former, so we should be a little cautious when others are still in euphoria.

The last couple of times I wrote about the markets, ‘Brexit Is Now a Reality, Now What?’ and also ‘Markets at New Highs, Should We be Concerned’ proved to be spot on and we were able to take advantage of both fear and greed in the markets.

So question is where are we now?

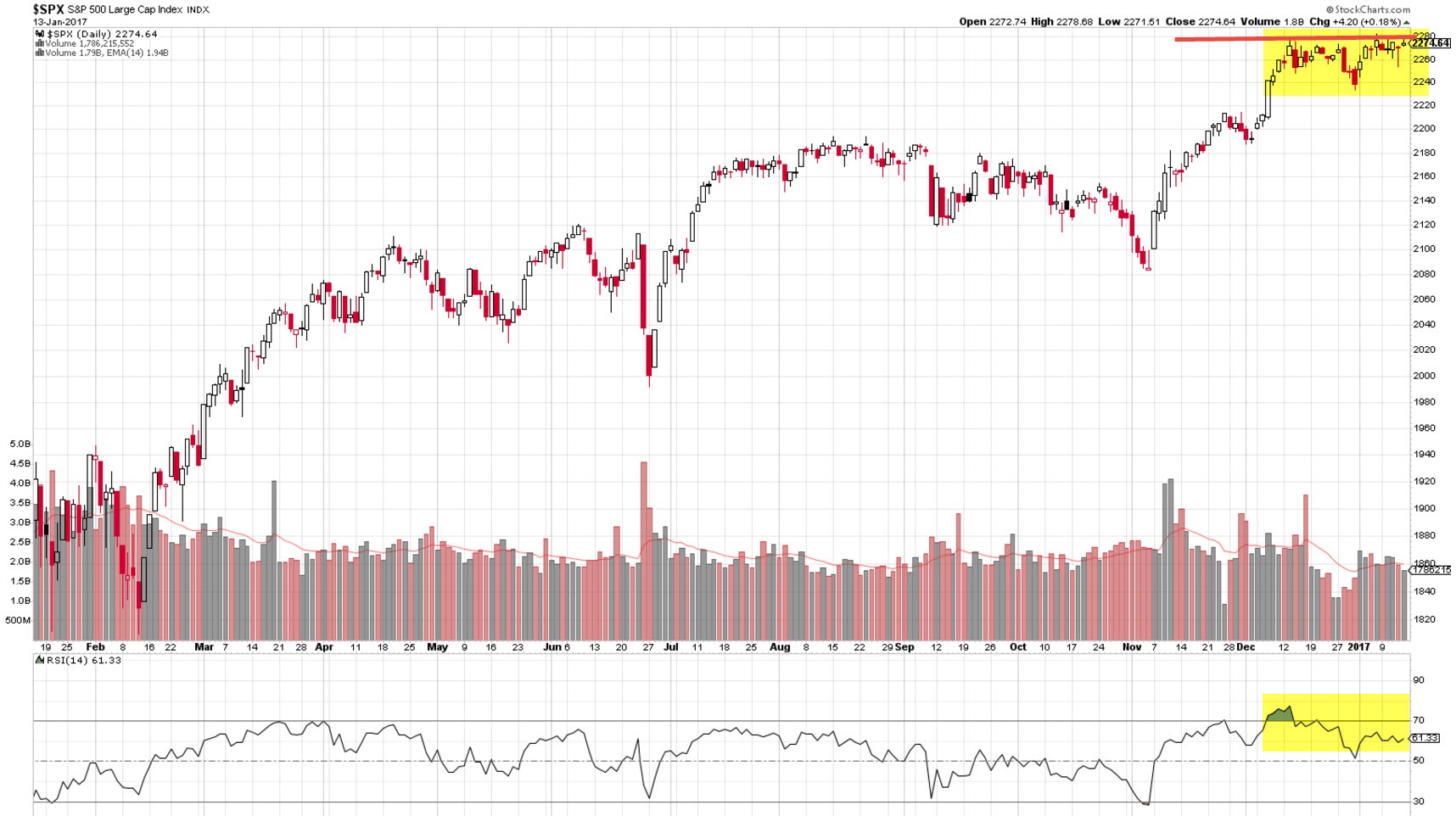

The markets are now at new highs, pushing towards the 2,280 mark on the S&P500 and the magical 20,000 on the Dow. There seems to be this incorrect perception that once the 20,000 is reached, the market will break out to the upside. But never forget that markets are made up of individual stocks, and if these stocks are well overvalued, there’s a higher probability that they will come down in price , rather than up.

The US markets have run very hard post the US Election outcome, fueled by the perception that a Trump presidency will dramatically increase economic growth with plans for heavy infrastructure spending and reduced corporate tax rates.

Only problem is, prices have run up so hard that value is now hard to find in bulk, and usually when this occurs, there is bound to be a short term pull back in prices.

The markets have already priced in much of this perceived growth, and a lot now has to work out as planned or the reverse will occur quite quickly.

So in my humble opinion, the markets have more probability of a short term pullback than further market highs. So patience grasshopper, patience…

Although I don’t expect a bear market anytime soon, I do believe the recent run up of the markets to new highs maybe unsustainable and a pullback is imminent in the short to medium term.

You only have to look at simple momentum indicators like the RSI that’s telling us to be a little more cautious.

Over the past fortnight, personally we’ve been selling down over priced stocks in our portfolios which have run up hard, locking in sizeable capital gains and now holding substantial cash which will allow us to capitalize on any pullbacks.

Could we be wrong? Maybe, but the odds are in our favor.

So you may also want to be a little more cautious in this current environment, than be complacent and get caught out on the reversal.

Only time will tell where the markets go from here, but we would rather be cautious and protect our capital first, than to try and capitalize on high risk opportunities. I always refer high growth low risk, opportunities.

See how you can easily protect yourself from market corrections, click here.