Saturday, 31.1 – 2009

Something I see. Gold might come as trade of the year, but perhaps it need to pause also for a while, be aware that in commodity sector W5 is very often longest wave.

I can bring only very little hope anymore, but see how deeply waves works with retracements. With SPX there´s little hope it would build even bigger HS on future missing right shoulder, but I am afraid we´re inside of impulses allready and very deep of them and nothing much going to change it much in long run.

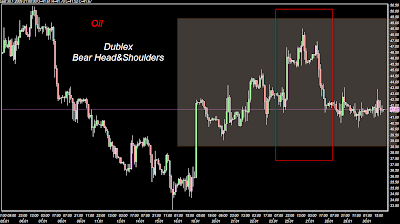

The good news is that QQQQ, SOX, OIH, XLE all trade just above of SMA-50 line with no extreme bear setups available via oscillators either. It seems to be mostly industrial stocks are taking free landing. With that Eur-Usd DoubleBottom, perhaps there´s hope at least one wave ended, but sooner or later we will just change new impulse wave from one to another.

We´re in deflation now officially, in long run I don´t see much places to buy real long term holdings for very long time. I had been wondering for real long if eur-usd is leading stockmarket and once again I think last week showed it does, it´s far ahead of stockmarket by EW point of view allmost in every EW timeframes.