As we enter the final day of the July options expiration, I decided to post about stocks which have a greater than 50% probability of yielding higher returns in just 1 day. These stocks all have higher Betas, which is essential to bring about better option premiums. The higher premium is necessary in order to write them out and return this gain in just one day. The strategy used is the Buy/Write option strategy, which means the stock is purchased and immediately an in the money covered call option is sold against it. The strike prices for these stocks are very close to the current share price of the stock (at the money). The premium received on the call option will outweigh the share price given up (results in a net gain).

(Share Price – Strike Price + Premium Received from call option) > Share Price

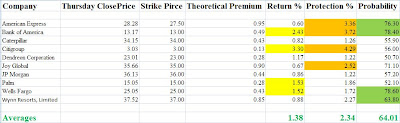

The stocks which yield the highest return and the greatest amount of downside protection are listed after the 10 Buy/Write option ideas.

To understand this post you’ll need a strong background of options. To learn more about options and, how options can help protect your portfolio, and allow you to speculate with less money up front click here.

All data as of market close Thursday July 16, 2009.

Buy Write Option Strategy #1: Buy American Express (AXP) stock and sell the July 27.50 Call option. This will give you downside protection of 3.36% for the day. The current options market is factoring in a 76.3% probability American Express will close at or above the indicated strike at the end of trade Friday July 17 yielding a 0.60% return.

Buy Write Option Strategy #2: Buy Bank of America (BAC) stock and sell the July 13 Call option. This will give you downside protection of 3.72% for the day. The current options market is factoring in a 78.4% probability Bank of America will close at or above the indicated strike at the end of trade Friday July 17 yielding a 2.43% return.

Buy Write Option Strategy #3: Buy Caterpillar (CAT) stock and sell the July 34 Call option. This will give you downside protection of 1.26% for the day. The current options market is factoring in a 55.9% probability Caterpillar will close at or above the indicated strike at the end of trade Friday July 17 yielding a 0.82% return.

Buy Write Option Strategy #4: Buy Citigroup (C) stock and sell the July 3 Call option. This will give you downside protection of 4.29% for the day. The current options market is factoring in a 56% probability Citigroup will close at or above the indicated strike at the end of trade Friday July 17 yielding a 3.3% return.

Buy Write Option Strategy #5: Buy Dendreon (DNDN) stock and sell the July 23 Call option. This will give you downside protection of 1.22% for the day. The current options market is factoring in a 50.7% probability Dendreon will close at or above the indicated strike at the end of trade Friday July 17 yielding a 1.17% return.

Buy Write Option Strategy #6: Buy Joy Global (JOYG) stock and sell the July 35 Call option. This will give you downside protection of 2.52% for the day. The current options market is factoring in a 71.1% probability Joy Global will close at or above the indicated strike at the end of trade Friday July 17 yielding a 0.67% return.

Buy Write Option Strategy #7: Buy JP Morgan (JPM) stock and sell the July 36 Call option. This will give you downside protection of 1.22% for the day. The current options market is factoring in a 57.2% probability JP Morgan will close at or above the indicated strike at the end of trade Friday July 17 yielding a 0.86% return.

Buy Write Option Strategy #8: Buy Palm (PALM) stock and sell the July 15 Call option. This will give you downside protection of 1.86% for the day. The current options market is factoring in a 52.1% probability Palm will close at or above the indicated strike at the end of trade Friday July 17 yielding a 1.53% return.

Buy Write Option Strategy #9: Buy Wells Fargo (WFC) stock and sell the July 25 Call option. This will give you downside protection of 1.72% for the day. The current options market is factoring in a 78.6% probability Wells Fargo will close at or above the indicated strike at the end of trade Friday July 17 yielding a 1.52% return.

Buy Write Option Strategy #10: Buy Wynn Resorts (WYNN) stock and sell the July 37 Call option. This will give you downside protection of 2.27% for the day. The current options market is factoring in a 63.8% probability Wynn will close at or above the indicated strike at the end of trade Friday July 17 yielding a 0.88% return.

Based on the analysis performed above the “Best Bang for Your Buck” stocks would be either Bank of America or Citigroup, as both stocks return and protect above average (of the 10 stocks analyzed).

NOTE: You may want to watch these stocks throughout the day as they move higher/lower and closer to a given strike price. This is because buying and writing closer to a strike price will yield a greater return. The probability won’t be as high but the protection and the return will be greater in most cases. The time values will evaporate throughout the trading day, but similar strategies can be used for the next option expiration. In some cases it is better to use this strategy the day before the option expiration and within 1 hour of the market close.

Keep in mind when using this strategy it is essential that broker commissions are low enough to profit from the position.

To see this strategy on a list of more volatile, higher return, greater downside protection leveraged ETF’s click here.

As a special thank you to my readers, I’ve created a printable spreadsheet, which clearly shows which stocks are above average by highlighting the % in a color.