Very nice, was off the full day and marked sold equities while most of the pairs seems have sideways progress, but not this one. EurUsd has advanced now fully 1000 pips exactly with the top price of 1.3935 since bottom of 1,2935.

For some reason every time I open the screen there´s tiny HS pattern for me it seems and I shorted immediately to achieve my daily +20 pips which seems to come regular issue at daily basis, but with much bigger spectrum it seems this channel really works – I have no idea why I have personal issue with it. E part in 60 min channel clearly breakes now for impulses. 1.4150 is going to be bigger set if it reached it as it´s 50% upside correction since entire bearmarket (or should it call bull nowdays).

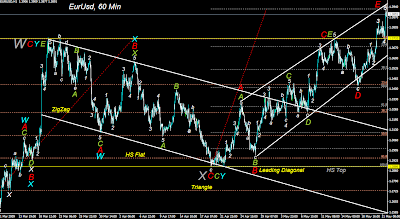

However much more intereresting as my scalping is this 60 min table because we can now take a look back much more pasted history to see something relations pinpoints to the upcoming issues.

Since last bottom with 1,2526 before the FED and before this triple correction and before this previous run either it started to progress up with triple zigzag (trees). This first upleg very clearly broke to the WXY pattern while W clearly broke to the triple trees. Entire size of this leg was 1211 pips starting from 1,2526 and ended with 1,3737.

1,3737 – 1,2526 = 1211 pips.

Now, let´s assume this 1211 would be A. Next it was retraced down with 38.2% (to achieve this 1.2935 bottom). Let´s call it B.

Conclusion; If A and C would come as similiar size we´re missing to blow rest of the C wave which I marked a-b-c-d-e (e on the progress) upside impulse in the chart and if it would be similiar size with A wave; 1,2935 + 1211 pips = 1,4146. Would you call this accident ?

Also, if we enter for bigger timeframe if C would come at some day with 1.618 relation to the A wave it pinpoints exactly to the 61.8% retracement area with the same chart for 1.5150 which again is also annual chart target for .618 wave, but let´s not get overestimate of timeframes yet. With WXY patterns, Y actually comes 1.618 relation and I have to confess that in real long run we´re going to run real high if my 60 min chart is correct.

However, I haven´t fill the chart with ABC waves as I cannot see first leg up as simple “A” wave, for me it´s W and I don´t think EW would provide B wave to be complex correction either – for me it´s X, but because all alternates are tradable that 50% is next now.

That´s my shorting target for it because 1.4150 marks also complete annual chart 50% retracement roof, with this big setup overthrow is more than likely, 1,4162 perhaps marks the top for it.

With this progressing speed, we´re very quickly on there, with todays speed example it´s only one day upleg if necessary. At least this pair is not boring, if it is on the next day everything has changed and it´s interesting again. I feel a little stupid in here, all this time all these weeks and months I had tracked right waves with my 60 min table but I haven´t actually traded them instead making all kind of weird own assumptions ending just scalping mode.

The real question is not if 1.4150 will be reached and short, the real question should be how far it can actually sell – this uptrend channel is very narrow and even 38.2% retracement correction might require to breake for it. Does it allow the breake lower channel at all while Y keeps uptrend running as higher degree.