By Tim Evans

We all witnessed a global equity market meltdown of equity prices over the last 12 months. During the same time frame, we saw a boom-and-bust cycle in commodities. In my opinion, we are now in the middle of a significant shift in dynamics for currency markets throughout the world.

Just like any market, the value of a currency is determined by fundamental supply and demand factors. On the demand side of the equation, a currency is more valuable when its respective economy is growing. If the economy is active and money is flowing into a country, this is viewed as positive for the country’s currency. To put it simply, an active and growing economy creates demand for the currency.

Interest rates also have a strong affect on the value of a currency. The old adage in the trading world is “money chases yield.” Money will seek the highest return by flowing to a country with higher interest rates. Therefore, demand will grow for the currency in the country with higher interest rates. Higher demand often leads to a stronger currency.

The economic turmoil of the last 12 months has led governments around the world to spend and print more money. This strongly affects the supply side of the equation in the currency markets. Given the deep global recession, governments around the world are trying to stimulate the economy, and they’re doing that by pumping more money into their economies. The increased supply of money, provided by central banks, directly affects the value of that nation’s currency. Ultimately, the balance of the supply and demand factors will determine the value of a currency that you see on a day-to-day basis.

Currencies and Commodities

Most people understand currencies as purchasing power. What do I have in my wallet or bank account, and what will it buy me? From an investment standpoint, it’s better to think of currencies as commodities similar to gold, silver or crude oil. Currencies are goods that are supplied and demanded. If you can view currencies as commodities, you’ll be better prepared to make investment and trading decisions.

The most important factor affecting currencies at the moment is government stimulus. Packages are seeping into economies throughout the world. The United States, in its last budget release, plans to spend $1.6 trillion, which will be the largest budget every signed by a U.S. president. The United States is aggressively printing and spending money in order to get out of the current recession. Similar stimulus packages are being attempted throughout the world. However, the amount of money being spent in these countries is far below the amount being spent in the U.S.

With the supply of money increasing at such a rapid pace, you can expect demand for commodities to also increase. Once that takes place, the behavior of investors will change.

In the last few months, stock markets throughout the world have rebounded. In general, emerging market equities have outperformed more developed nations, which signals that investors are seeking higher risk and higher reward for their investments.

The Euro

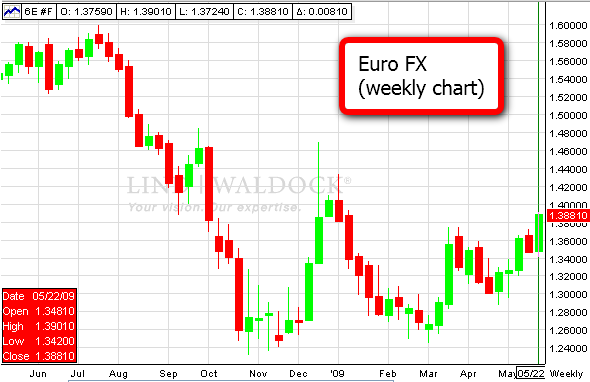

If you look at the euro currency since last year, you can see in the chart above that it has been a pretty bumpy ride. The value of the euro began dropping in August of 2008 as equity prices began falling. Panic began setting into the market and money was cashed out of risky assets and converted into U.S. dollars, which were viewed as the safest currency at the time.

As we approach the midpoint of 2009, the currency markets have been range-bound and choppy. Traders are still trying to figure out which economy will emerge from the recession first. The recent rally in the euro is being triggered by the tremendous amount of money being printed in the U.S.

The Australian Dollar

The Australian Dollar fell dramatically in August of 2008, as most currencies did, but this market has seen a stronger rally in recent months due to rising commodity prices. The Australian Dollar is known as a commodity currency. Many mining and industrial products come out of Australia. Therefore, as commodity prices rally, money flows into the industries that drive the Australian economy.

The U.S. Dollar Index

The U.S. Dollar Index measures the value of the U.S. dollar based on a basket of six major foreign currencies: the euro, Japanese yen, Canadian dollar, British pound, Swedish krona and Swiss franc. This index, which can also be traded as a futures contract, gives investors a broad idea of how the U.S. dollar is performing compared to numerous other currencies.

You’ll notice the difference in the chart above, compared to the last two (the euro and Australian dollar). In August of 2008, the value of the U.S. dollar began to rise as investors throughout the world liquidated their risk assets and held cash, specifically dollars.

From a technical perspective, keep your eye on the 200-day moving average (MA), which is a very pivotal number to watch (as shown in the chart above). When the market is above the 200-day moving average, the bulls are considered to be in control. When the market is below the 200-day MA, the bears are in control. As of this writing, the Dollar Index is trading below the 200-day MA near 81.00, indicating a bearish sentiment in this market.

Where Do We Go From Here?

I think the trend in the dollar, as it heads lower, is a trend that will continue into the end of this year and into 2010. Once the U.S. government’s $1.6 trillion begins to circulate, that will be very inflationary for commodity prices. Therefore, I think commodity-based currencies such as the Canadian dollar and the Australian dollar could do very well in this environment. Canada has a huge stockpile of crude oil and Australia has a very large mining industry. As inflationary pressure builds up, you’ll notice currency flows entering commodity-based economies and away from service-based economies like the United States.

The risk appetite around the world is beginning to return. We’ve seen that from the dramatic drop in the Volatility Index (VIX), viewed as a gauge of investor “fear,” as it fell under 30 for the first time in nearly nine months. Equity markets worldwide have been very strong in recent months. Investors and traders are seeking assets that will provide higher returns, and thus higher risk. This is not good for the value of the U.S. dollar. I would expect the U.S. Dollar Index to fall well below 70 as the risk appetite of investors continues to increase.

If you look at a longer time-frame, (as shown in the chart above) the U.S. Dollar Index is currently trapped in a long-term bear market that has lasted nearly a decade. In my opinion, it might not be such a good idea to fight such a strong trend to the downside.

Tim Evans is a Senior Market Strategist with Lind Plus. He can be reached at (800) 798-7671 or via email at tevans@lind-waldock.com.

You can hear market commentary from Lind-Waldock market strategists through our weekly Lind Plus Markets on the Move webinars. These interactive, live webinars are free to attend. To sign up, visit https://www.lind-waldock.com/events/calendar.shtml. Lind-Waldock also offers other educational resources to help your learn more about futures trading, including free simulated trading. Visit www.lind-waldock.com.

Past performance is not necessarily indicative of future trading results. Trading advice is based on information taken from trade and statistical services and other sources which Lind-Waldock believes are reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. All trading decisions will be made by the account holder.

Futures trading involves substantial risk of loss and is not suitable for all investors. 2009 MF Global Ltd. All Rights Reserved. Futures Brokers, Commodity Brokers and Online Futures Trading. 141 West Jackson Boulevard, Suite 1400-A, Chicago, IL 60604.