By: Scott Redler

Traders love to buy break outs and short break downs, thriving on momentum and follow-through. In today’s market, we are seeing NONE of this.

The only way to make money has been to watch the short term or intermediate term trend. Define all the ascending channels/trends and once they break you get out and short. Then define the descending channels/trends and when they break cover and get long. Each time these channels break they’ve lead to 5%-10% moves that all took place in a pretty short time. But this is very hard to do, especially if you try and throw around any size.

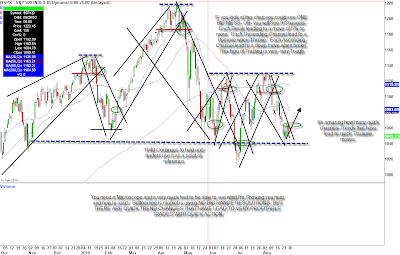

I attached a chart that shows you nine different channels since the beginning of the year. Try not to get dizzy because it is hard to see, but you will see nine green circles that show you when you had an action area or a day to switch quick, from long to flat or short, or from short to flat or long, all depending on how quick and nimble you are.

I’ve tried to send these charts out each time before the break and then the day of the break. It is definitely not easy!

As of now, we held 1040 again and have short term support in this area once again. We now have a descending trend or channel that will be challenged on the open today. If we hold above 1055-1060 today, we will see more of a squeeze. Some leaders are holding well, and held lower range with some even breaking out without the market in a confirmed rally. Big resistance comes in at the 1077-1082 area.

This is my list of the best acting stocks, or the ones that I look at each day and trade:

AAPL, BIDU, AMZN, VMW

CRM, FFIV, NFLX

ISLN, SPRD,

TSL

POT, CF, AGU

GLD, NEM, AU

FCX, X

Sometimes in the beginning of the month, new money gets put to work. Now that everyone got most stocks off the books for August, a day like today will confuse most.

If you look at the year over year action, this was supposed to be a consolidation year, a year that digests the big 60%-70% or so move off the 2008 lows. Trade the short term trends, rotate both long and short through sectors as the market digests the big move off the 2008 bottom. That’s exactly whats been going on!