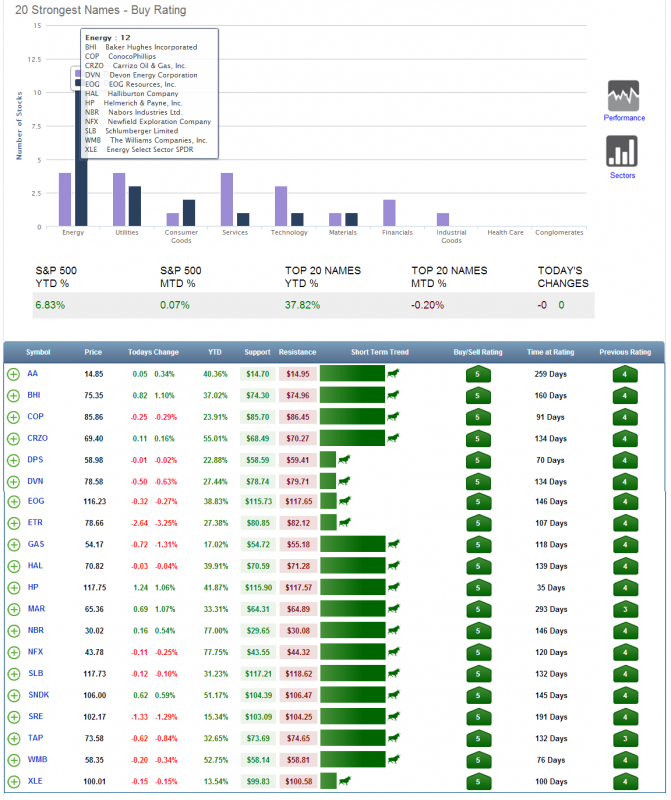

Today we are looking at the 20 strongest stocks within the S&P 500. As seen from Figure 1 below, the blue bars represent the percentage of stock in each sector. You will notice that 55% of the strongest stocks are comprised of energy related names.

How It Works

For those of you who are not familiar with ChartLabPro.com’s rating system a 5 is considered a strong buy. You will notice from the chart that the average duration of since these energy names moved to a strong buy is 130 days. Meaning we started to get long these names in February. Not until the last several days have most of these names moved to an overbought condition. This is not a mean reversion overbought call; it is a precaution to reduce equity exposure to raise cash and look for other sector opportunities as they arise.

Overbought Names

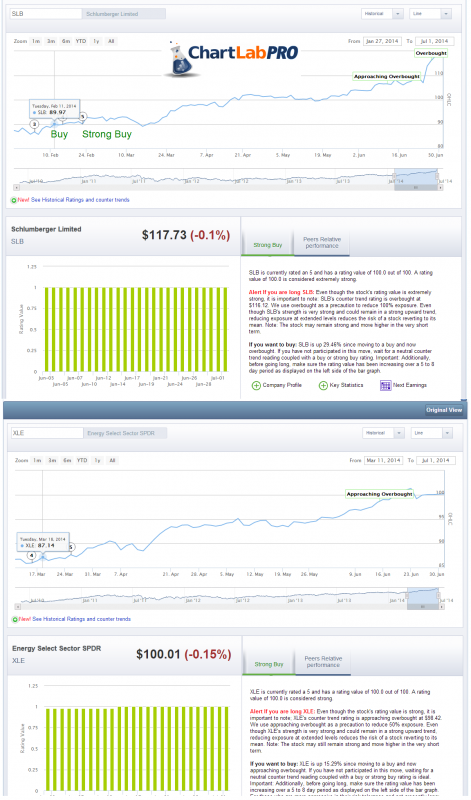

The most overbought energy names are Newfield Exploration, Conoco Philips and Schlumberger (see chart below). For those who trade ETF’s, XLE (see chart below) is sitting on the borderline of being overbought and is only consider approaching overbought at this juncture.

Reduce Exposure

For those who caught this run early on, reducing exposure is prudent. As we roll into the second half of the year, let’s wait and watch tp deploy new capital to the next high probability sector play as it emerges.

= = =

Please don’t forget, prices are going up next week for www.ChartLabPro.com, so get grandfathered in for life now.