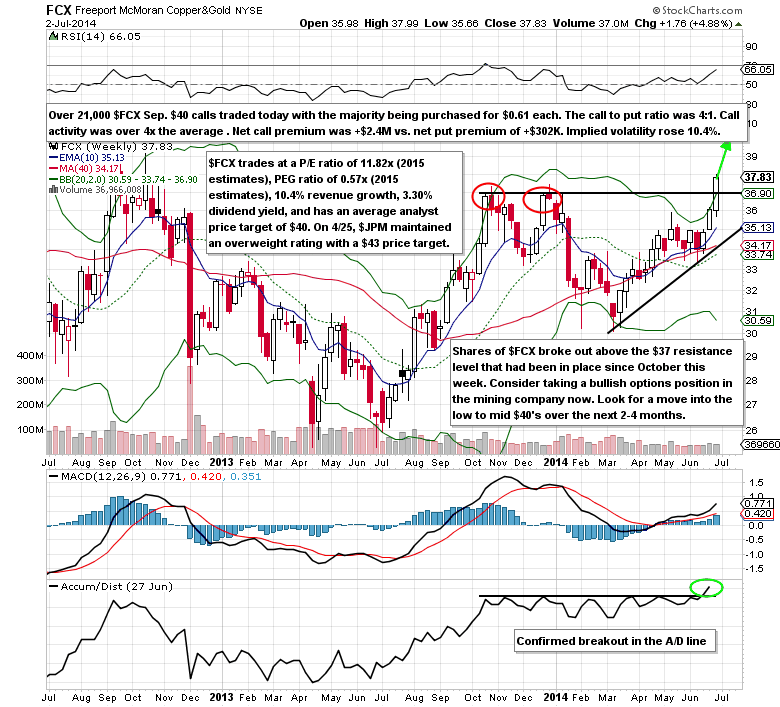

Freeport-McMoRan Copper & Gold (FCX), an international mining company, shares are up just 2.08% year to date compared to the S&P 500’s (SPX) 6.83% gain. This underperformance has made Freeport an attract investment at a P/E ratio of 11.82x (2015 estimates) vs. the S&P 500 at 15.68x (2015 estimates). When factoring in earnings growth Freeport trades at a PEG ratio of 0.58x (under 1.00x is cheap on a valuation basis) and has revenue growth of 10.4%. The dividend yield at 3.30% is comparable to the Utilities Select Sector SPDR’s (XLU) yield of 3.43% and much higher than the SPDR S&P 500 Trust (SPY) yield of 1.81%. The average analyst price target is $43 (13.67% above the current share price). On April 25th, J.P. Morgan Chase maintained an overweight rating with a $43 price target. Even at $43, the stock would still only be trading at a P/E ratio of 13.44x (2015 estimates).

Unusual Options Activity

On July 2, more than 21,000 Sep $40 calls traded with the majority being bought for $0.61 each. The call to put ratio was 4:1. Call activity was over four times the average daily volume. Net call premium was +$2.4M vs. net put premium of +$302K. The implied volatility rose 10.4% to 23.34. The day before the Sep $40 call buying someone rolled out 5,858 Aug $36 calls (credit) into 8,787 Aug $38 calls (debit).

Technical Analysis

The large upside call buying spurred a close above the ten-month resistance level at $37. This breakout sets up for a move up to the early 2012 levels in the low to mid $40’s later this year on a measured move basis ($37-$30=$7+$37=$44).

Trade Idea

Buy the Sep $38 call for $1.50 or better

Stop loss- None

First upside target- $3.00

Second upside target- $4.50

Disclosure: I’m long the Sep $38 calls for $1.39 each.

= = =

Mitchell’s Free Trade of the Day featuring Melco Crown Entertainment (MPEL)