EUR/USD

The Euro avoided a test of fresh November lows on Wednesday and staged a corrective recovery later in the US session.

There were no major developments following the European ECOFIN meeting with markets still anxious for further developments surrounding the Irish debt situation. There were indications that Ireland will work with an EU and IMF mission to discuss the banking and debt stresses. There will be expectations that a support agreement will be worked out within the next few days and this should help underpin the Euro.

There will still be a high degree of uncertainty and there will also be major fears surrounding the contagion threat from other weaker members. There were further fears surrounding the Greek fiscal situation with speculation that amendments to the budget would potentially invalidate the EU support package agreed earlier this year. In this environment, there will be further doubts surrounding the longer-term Euro outlook.

The US economic data was weaker than expected with housing starts falling to a an annualised rate of 0.52mn for October, the lowest rate since April 2009 and significantly weaker than the markets expected. The latest consumer inflation data was also benign with core prices rising 0.6% over the year, the slowest increase since 1957.

The data increased expectations that the Federal Reserve would sanction all the planned quantitative easing planned over the next few months and this was significant in curbing yield support for the US dollar. In this environment, the Euro recovered to near 1.36 in Asian trading on Thursday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to maintain momentum during Wednesday as technical resistance levels held and the US currency drifted weaker as buying support faded.

The US economic data provided no support for the dollar as the combination of weaker housing starts and subdued consumer inflation put downward pressure on Treasury yields.

There was some easing of risk aversion during the session which helped curb defensive yen demand, but there were still fears over a further increase in Chinese interest rates which curbed enthusiasm towards risk assets and also lessened potential selling pressure on the yen.

The dollar edged weaker to the 83 region early in Asia on Thursday with the yen slightly weaker on the main crosses as equity markets advanced.

Sterling

Sterling found support above 1.5850 against the dollar on Wednesday and attempted to correct higher, but found it difficult to make much headway with the Euro consolidating above 0.85.

The latest UK labour-market data was stronger than expected with a decline in the unemployment claimant count for the first time since July. The data will help underpin short-term confidence towards the economy, but there will still be expectations of a weakening over the next few months as fiscal tightening takes effect.

The latest Bank of England MPC minutes were broadly in line with expectations as there was a 7-2 vote for an unchanged policy with Sentence again voting for a 0.25% interest rate increase while Posen wanted an expansion of quantitative easing. The noting of inflation concerns by a majority of members will provide some Sterling support.

Euro-zone developments will be watched closely with potential capital inflows as safe-haven from the Euro will be offset by fears that there will be a potential strain on the UK banking sector. Sterling consolidated close to 1.59 as volatility faded, at least in the near term.

Swiss franc

The dollar was unable to make a fresh challenge on parity against the franc on Wednesday and retreated to lows near 0.9880 in Asia on Tuesday. The Euro was unable to extend its recovery against the Swiss currency, but did avoid renewed selling pressure.

Any rescue deal for the Irish economy would be likely to curb immediate defensive demand for the franc, but underlying stresses are liable to persist and this is likely to maintain underlying defensive demand for the Swiss currency which should limit losses.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

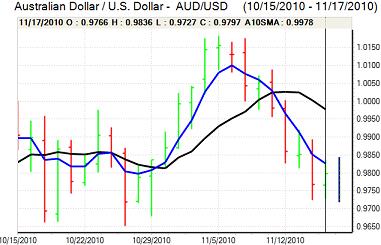

Australian dollar

The Australian dollar found support on dips towards the 0.9725 area against the US currency on Wednesday and steadily recovered during the day with a high near 0.9860 on Thursday.

Risk conditions stabilised during the day which helped support the Australian dollar while there was also a dip in demand for the US currency and Reserve Bank official Battellino voiced concerns over potential inflation pressures.

There will still be fears over a further increase in Chinese interest rates which will tend to dampen demand for the Australian dollar, especially as commodity prices would tend to be weaken if China does tighten.