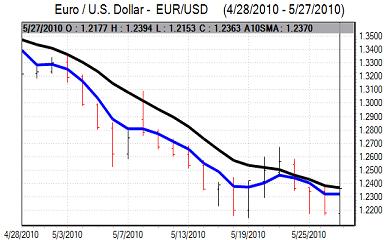

EUR/USD

There was relief that Euro technical support levels held and the currency rallied back to the 1.2250 area in early Europe on Thursday as some bargain hunting for the currency also emerged after a sustained period of pressure.

Immediate fears over the Spanish debt situation eased slightly which tended to curb further Euro selling. There were denials from Chinese authorities that they would look to reduce their Euro-zone debt holdings which helped stabilise sentiment towards the currency. Interbank money-market tensions also eased slightly during the day which tended to curb defensive demand for the dollar.

The US economic data was weaker than expected with first-quarter GDP revised down to an annual rate of 3.0% from a provisional 3.2%. There was a decline in initial jobless claims to 460,000 in the latest week from a revised 474,000 previously, but this was higher than expected which will raise some doubts over labour-market strength. The dollar gained ground following the release, but the Euro gained support from the ability to withstand a further attempt to break technical support close to the 1.22 level.

Risk conditions stabilised during the US session and there was a notable covering of short Euro positions. In this environment, the Euro rallied strongly to highs near the 1.24 level later in the New York session. With US and UK market holidays on Monday, there will be further speculation over a covering of short positions during Friday and choppy trading positions are liable to continue.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The latest Japanese trade data recorded an annual increase in exports of just over 40% which should provide some degree of relief for the Finance Ministry. There will still be a reluctance to let the yen strengthen significantly, especially with important fears over underlying deflationary pressures.

Risk appetite attempted to stabilise in Asian trading on Thursday which dampened defensive demand for the yen and the dollar was able to consolidate above the 90 level with Euro support below the 110 level.

The yen gained some initial support following the weaker than expected US data, but the currency was unable to make much headway and there was renewed selling pressure later in the US session. The dollar pushed to a high near 91 against the Japanese currency before edging weaker and there was evidence of significant yen under-performance on the crosses with a strong corrective Euro recovery.

Sterling

Sterling probed resistance levels above 1.45 against the dollar on Thursday helped by wider losses for the US currency and some improvement in Sterling support.

There was significant speculation over merger activity during the day which had an important currency impact. Initially, there were reports that the Prudential Corporation would abandon its takeover attempt for the Asian operations of AIG. This speculation provided initial Sterling support on expectation of lower capital outflows, but the company later insisted that it would push ahead with the deal.

The UK CBI retail sales data was significantly weaker than expected with a sharp decline to -18 from +13 the previous month and this was the lowest reading since March 2009. Retailers were also generally pessimistic over the outlook for June. The data is prone to monthly volatility, but there will be some degree of unease over future spending trends.

Position adjustment was important during the day and Sterling gained important support on a wider correction in European currencies with a peak close to 1.46 against the US dollar.

Swiss franc

The dollar hit resistance above 1.1650 against the Swiss franc on Thursday and weakened steadily to lows below 1.15 during the New York session. The Euro found support below 1.4150 against the Swiss currency and rallied to a high above 1.4250.

Position adjustment may trigger a further limited Euro recovery, especially if equity markets gain further ground, but the Euro will find it difficult to gain sustained support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

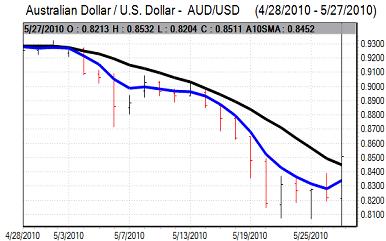

Australian dollar

Australian dollar selling pressure was more contained and the currency rallied again to the 0.8350 area on Thursday as the US dollar also retreated significantly. There was a decline in capital spending in the latest data which will undermine confidence to some extent, but international trends dominated during the session.

Risk conditions improved during the day and there was evidence of a reduction in short positions which helped propel the Australian dollar to a high around the 0.85 level later in New York.