(Click Image to Enlarge/ Glossary)

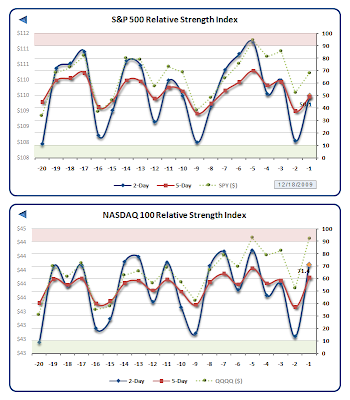

(Click Image to Enlarge/ Glossary) Dollar strength on the back of the FOMC’s quantitative easing withdrawal time line left the S&P 500 (SPY) down -0.3% even as the less sensitive Russel 2000 (IWM) finished up +1.7%. In as much as currencies often trend, the US Dollar (UUP) is now overbought on multiple time frames — perhaps a brief pause or pull back will offer year-end relief to equities. Meanwhile, holiday shortened week Fifty Two of 2009 features another busy economic calendar, including a Third Quarter GDP revision:

Dollar strength on the back of the FOMC’s quantitative easing withdrawal time line left the S&P 500 (SPY) down -0.3% even as the less sensitive Russel 2000 (IWM) finished up +1.7%. In as much as currencies often trend, the US Dollar (UUP) is now overbought on multiple time frames — perhaps a brief pause or pull back will offer year-end relief to equities. Meanwhile, holiday shortened week Fifty Two of 2009 features another busy economic calendar, including a Third Quarter GDP revision:

- Yahoo! – U.S. Economic Calendar

- Yahoo! – U.S. Earnings Calendar

A Happy Holidays to all of my Market Rewind readers!

If you are interested in a significantly more thorough version of this weekly summary, consider taking a look at Market Rewind’s nightly ETF Rewind Pro service. In addition to coverage of nearly 200 ETFs across twelve major asset classes, you will find three model portfolios, daily market signals and commentary, pairs trading and various powerful portfolio management tools.

If you are interested in a significantly more thorough version of this weekly summary, consider taking a look at Market Rewind’s nightly ETF Rewind Pro service. In addition to coverage of nearly 200 ETFs across twelve major asset classes, you will find three model portfolios, daily market signals and commentary, pairs trading and various powerful portfolio management tools.

Never Investment Advice: Prior Weekly Summaries