For many novice traders who begin showing interest in technical analysis they read a lot about oversold and overbought markets. The money signs flash in their eyes at the thought of how simple trading must be as they start penning a letter to Buffet that he should prepare to relinquish his seat to them on the Fortune Magazine’s Billionaire List. Not so fast!

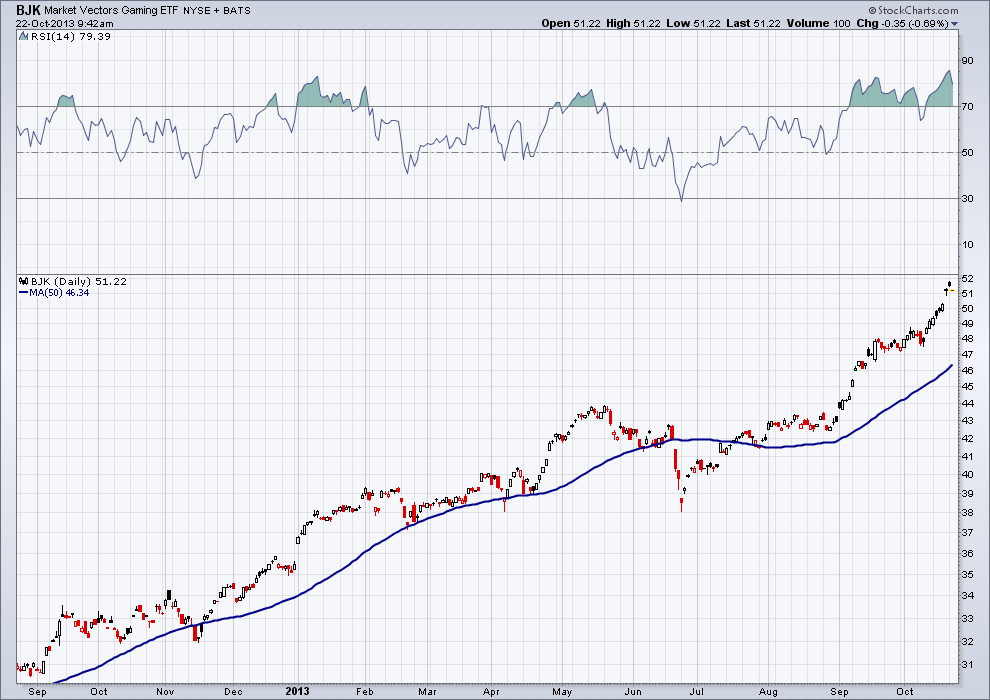

The quote from Keynes that “Markets can remain irrational longer than you can remain solvent.” comes to mind on the topic of extended ‘overbought’ markets, stocks, and ETFs. A great example of this right now is the Market Vectors Gaming ETF (BJK). Typically when the Relative Strength Index, a momentum indicator, breaks above 70 it’s considered ‘overbought’ and when under 30 it’s ‘oversold.’ In my opinion overbought and oversold markets must be viewed differently and require different strategies. For the purpose of this article I want to focus on the overbought status.

In January BJK was above 70 for all but one day as it wrote over 10%. For the better part of the year, excluding the drip in June, the gaming ETF has stayed in a bullish range as it trekked higher as the RSI indicator found support near the 40 and 50 levels. Looking at the last two months most of the trading has been taking place with momentum ‘overbought.’ Did traders run away in mass as RSI broke 70 and then 80? Nope. Instead they pushed the ETF up nearly 20% while the S&P 500 gained a little more than 5%.

So what does it all mean? Price action must be taken in context of the overall move. The extended period above 70 earlier this year was a clue that buyers had fallen in love with the gaming ETF. When the RSI is above 70 it just lets us know that there is a somewhat abnormal (but can be healthy) demand for a security. In other words, buyers are coming in, not leaving. This means before jumping on the short bus just because buyers have pushed an indicator into being ‘overbought’ review other components of the chart and understand what ‘overbought’ truly means.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.

= = =

Read more of Thrasher’s work here on his blog.