Continuing my exclusive TraderPlanet series on using Elliott wave principle (WP), I am now focusing on the rules and guidelines that are used when applying the WP and looking for potential trade set-up opportunities.

SILVER MARKET

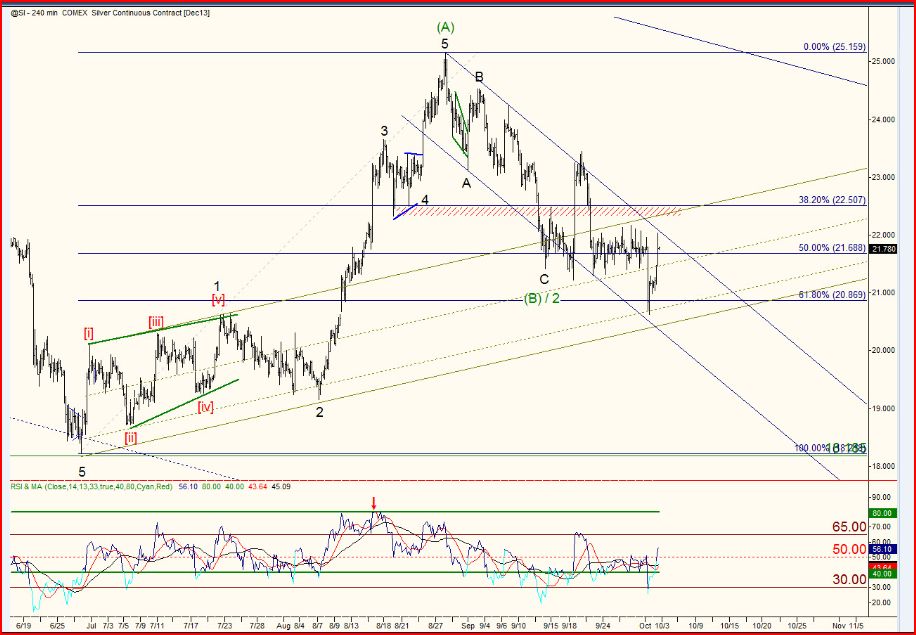

I left you on the previous article with a chart of Silver futures where I had used multiple guidelines to help me come to the conclusion that there was a possible five wave structure completed in silver and that a correction had likely got under way.

Our minimum target would be the fourth wave of one lesser degree which lined up nicely with the 38.2% retracement of the five wave structure in question. But from our guidelines we are aware that:

The 38.2% retracement is a more common target for fourth waves and that 2nd waves and “B” waves often register a deeper retracement 50%, 61.8%, 78.6% or even deeper. (Remember 2nd waves cannot retrace more than 100% of wave one)

Also the Basing Channel is likely to support price for the duration of the wave degrees relating to the same channel.

And corrections themselves especially Zigzags are contained within the confines of a parallel trend channel.

LAST MONTH’S CHART

HERE IS WHAT HAPPENED

Without altering anything on the chart we certainly got what we were looking for…. And more!

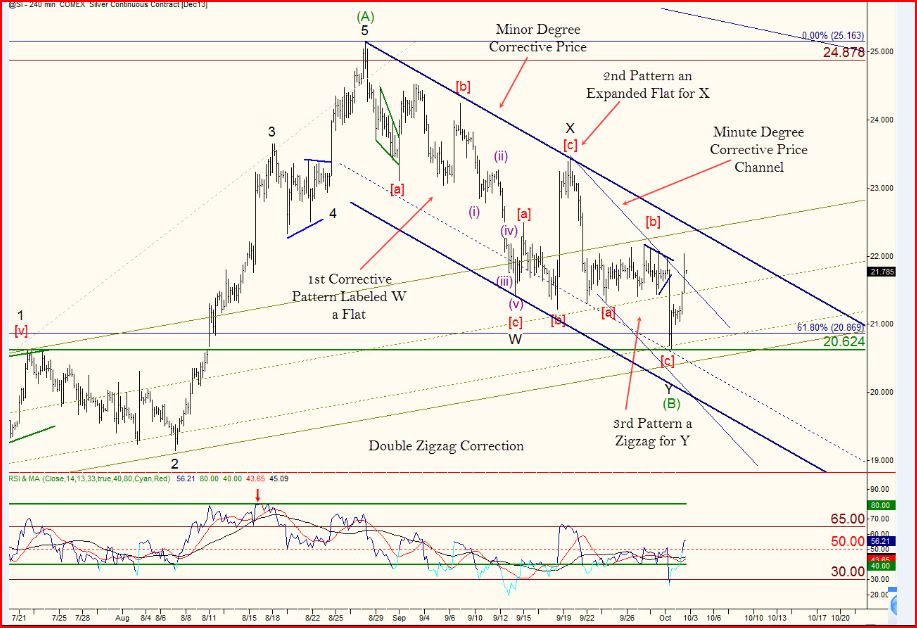

Although the channelling done an excellent job in guiding price to its support area for now, we need to update the labelling and with that we can adjust the channelling to be more precise with our analysis and trading in general. I personally do not see the point in having wide stops I prefer to know when I am wrong at a specific level for a particular reason. That is why I take care and precision in applying my trendlines and Fibonacci grids. I advise you to get into that habit early too.

WHAT’S AHEAD FOR SILVER?

For now my preferred count is still that we are correcting a five wave impulse and this opinion is supported with price continuing to trade within the confines of a corrective trend channel. For a double zigzag we take a trendline from the origin of the pattern off the “X” wave and extend it from the termination point of the first pattern wave “W”.

Notice the lower degree corrective channel for the Minute degree zigzag (wave Y). Price has broken out of that which could be the early signs that this larger degree correction is complete and price is getting ready to take off in wave (3) or (C). We will need a bit more confirmation to add confidence to that opinion just yet.

Also see how I am using parallel lines to the channels and using them internally also. Look for areas in the past that price respected that angle of trend.

GET STARTED

Why don’t you use the tools and techniques I have discussed to date and we will meet back here again next month for another update on the white metal.

Learn more about Madden’s work at Elliott Wave Ireland here.

= = =

Have you seen the latest issue of the TraderPlanet Journal?

Read the cover story interview with Investor’s Business Daily’s Bill O’Neil