I haven’t written an article on gold in quite some time. It’s actually one of my favorite ETF’s to trade. SPDR Gold Trust ETF (GLD) has great volatility. It moves often, has weekly options, has $1 strike prices on those options and also has mini options. So, it offers a plethora of leverage, especially for anyone who owns the shares.

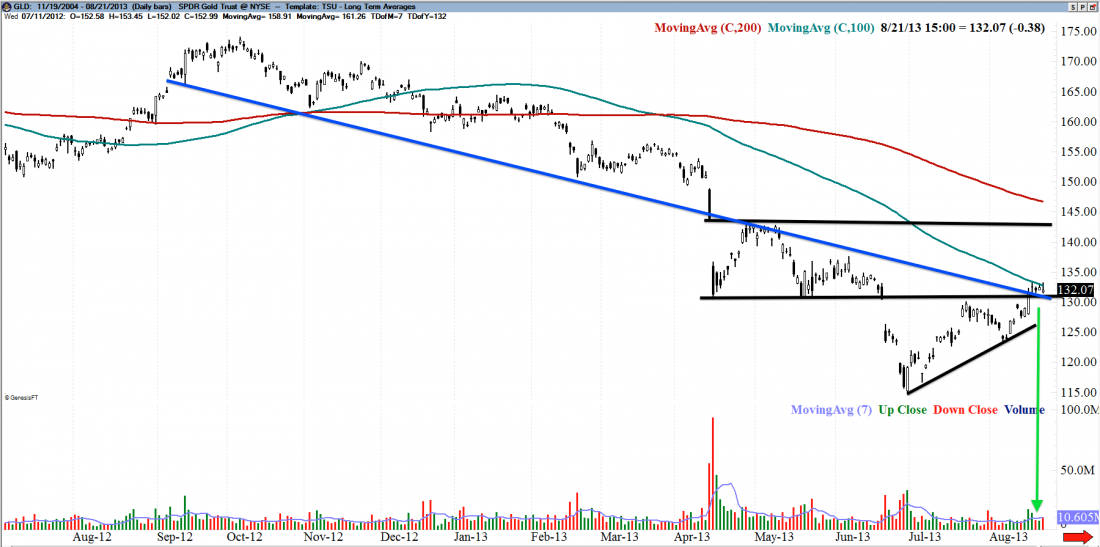

GLD had some beautiful bearish moves a few months ago and we were really ready for it. A retracement is needed in GLD and a lot of investors and traders are seeing this as a buying opportunity. GLD has already broken strongly through its 100 SMA. As you can see on the chart, with the lime green arrow, volume has really declined recently as the GLD ETF has approached this resistance. There is a pretty strong and significant resistance at this level. The blue line is a bearish trend line and the black line was a short term resistance. Both those prices will now act as a support.

The last four days look very much like a stair step pattern, which is a continuation move. If GLD breaks the resistance, it would be a continuation trade. If GLD is above $133.62 after 11:30 am EDT, I would consider a bullish entry. Target would be the 200 simple moving average, around $145.

I would want to give the trade some time for sure. I personally trade options and I feel November expiration would be a good time frame for the trade. My stop would initially be placed at $129. This represents about a $4 risk to gain close to $10. 1:2.5 risk to reward. If the trade doesn’t trigger, that’s great! If it does, trade your plan. The risk to reward ratio looks healthy. GLD is above the exponential moving averages, it’s into the top Bollinger Band, the relative strength index has room to move and GLD has made higher lows and higher highs relative to the beginning of July.