Market sentiment still appears to be quite bullish on several fronts.

AAII SENTIMENT

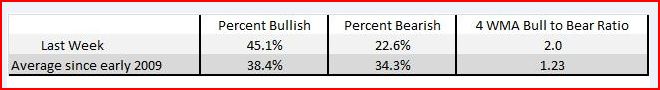

One item we tend to track is the American Association of Individual Investors (AAII) Sentiment Survey. Taken from their website, “The AAII Investor Sentiment Survey measures the percentage of individual investors who are bullish, bearish, and neutral on the stock market for the next six months; individuals are polled from the ranks of the AAII membership on a weekly basis.”

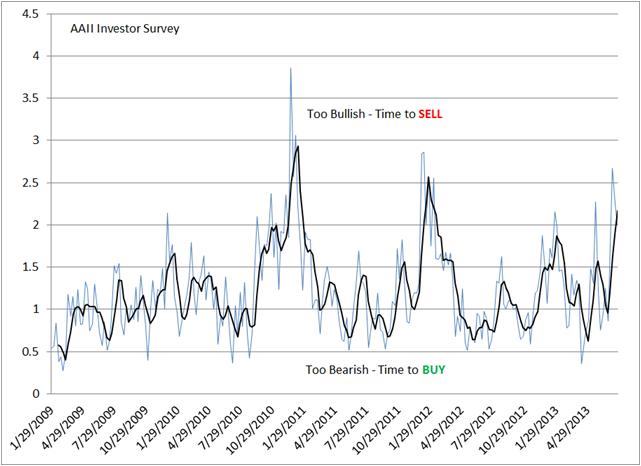

BULL/BEAR RATIO AT AN EXTREME

Last week, the survey produced 45.12% of respondents saying they are “bullish” towards the market and only 22.56% claimed to be “bearish. The bull to bear ratio has been above 2.0 for the past three weeks and four week moving average is above 2.0 this week. These are considered extreme levels.

BUT…

These trends are much higher than the average sentiment readings coming from the start of the current bull market from early 2009. While this reading should be considered a contrarian indicator, history shows us that this early warning system has a tendency to be too early.

Back on 12/16/10 the four week average for the ratio broke above 2.0 and stayed there for seven weeks. The S&P 500 went on to produce a 7.1% upside move over the next two months. On 1/12/12 the four week average broke above 2.0 and stayed there a total of six weeks. Once again the S&P 500 gained substantially over the next two months tacking on 8.3%.

THE MARKET IS ALWAYS RIGHT

Many of our indicators have been calling for a correction on the horizon. While we firmly believe that we are long overdue for a healthy pullback, one needs to also understand that the stock market has ways of humbling even the most sincere of traders. Too many times investors have been hurt waiting for the market to “get it right.” The market is always right and we need to adjust our thinking to understand that concept.

Our timing was off in calling for the correction and we cannot afford to fight the trend. We covered our inverse (short) positions weeks ago and have decided to go with a long bias considering the resiliency of the market and the Fed’s commitment to continue to support it.

KEEP STOPS TIGHT

Based on the AAII sentiment data, we could be in for several more weeks of strength that we hope to capitalize on. We will keep the stops tight and be ever vigilant in looking for the turn that could morph into that ever elusive correction that we’ve been waiting two months for.