The major averages remain in confirmed uptrends which means it’s important to keep an eye on stocks with strong fundamentals showing relative price strength. Some will eventually go on to be big market leaders — especially newer companies still in the early stages of growth.

It wasn’t that long ago when my screens were teeming with China-based growth stocks under accumulation. It’s not so much the case now, but China-based Qihoo (prononounced “chi-hu”) 360 Technology (QIHU) has the look of an emerging leader.

The company has all the qualities I like to see in stock: Big earnings and sales growth in recent quarters, bright growth prospects and high return on equity. It’s also a stock that remains under accumulation by institutional investors. The China-based firm, with a market capitalization of $2.9 billion is very liquid with an average daily volume of 1.7 million shares. It’s a provider of Internet and mobile security products in China. It went public in March 2011 at $14.50 a share and closed at $34 on its first day of trading.

Last month, Qihoo reported strong third-quarter results, with profit up 25% from a year ago to $0.20 a share. Sales rose 77% to $84 million. The company gets most of its revenue from internet advertising (70%) and value-added software, including video games (26%). In August, Qihoo launched its own Internet search engine which, according to some estimates, has already gained 8% to 10% of the search market in China. It’s not surprising to see institutional investors continue to dump Baidu (BIDU) and gravitate toward Qihoo.

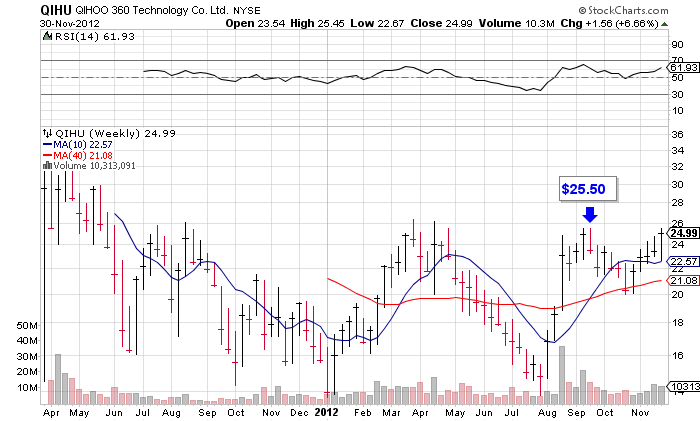

Qihoo is expected to grow annual earnings by 45% this year (compared to 2011) and 46% in 2013. Remember that earnings growth and institutional buying are the main drivers of a stock’s price and Qihoo has both. The stock is quickly approaching its recent high of $25.50, bringing the possibility of a technical breakout into play. Still, after five straight weekly price gains, I wouldn’t be surprised to see a low-volume pullback to shake out the last remaining sellers in the stock. This would also be constructive price action.