One of the best places to get an ‘inside’ look at the markets is from the weekly CFTC Commitment of Traders (COT) report that is published every Thursday. We can use this data to get a sense for how traders are actually positioned in a specific market, whether it’s lumber, corn, the yen, or the S&P 500, etc.

Each week the CFTC releases the position data of commercial, hedge, and small traders. A commercial trader as defined by the CFTC is “an entity involved in the production, processing, or merchandising of a commodity.” But when it comes to financial markets, commercial traders are the dealers within the market (like index futures and currencies). The chart we are going to look at today involves all three types of traders but we are going to focus in on the commercial/dealer since they are often deemed the ‘smart money.’

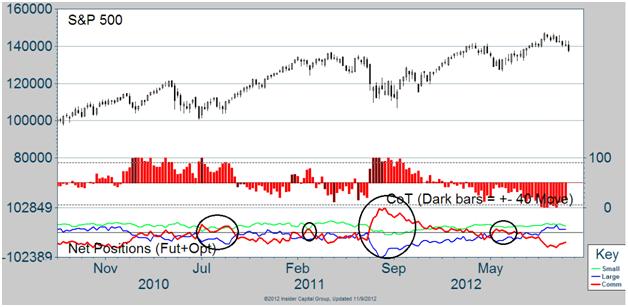

Looking back at the previous dips in the market, specifically June/July 2010, February 2011, August/September 2011, and May 2012, there is a common theme that we can see in the COT data. Looking at the below chart, we notice that commercial trades (red line) become net-long (long positions minus short positions) at market bottoms. I’ve put a black circle around the previous four instances of this happening, each being at or near a trough in price.

Now if we turn our focus to the more current price action we can see that commercial traders are still net-short futures and option contracts of the S&P 500. This lets us know that the dealers trading S&P futures and options are still not convinced that a bottom has been put in for the equity index, and that further weakness is still possible.

While pundits and journalist fill the airwaves with what the market is doing and could be doing in the future, it’s much easier to turn to the actual position reports of those actually trading a specific market. And in the case of the S&P 500, the data doesn’t seem to be calling for a bottom in equities quite yet.

Disclaimer: The information contained in this article should not be construed as investment advice, research, or an offer to buy or sell securities. Everything written here is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned.

= = =

Read more daily trading ideas here.

[Editor’s Note: What do you think? What are you watching to determine if there is a bottom for stocks? Let us know below.]