When the market’s in a downtrend like it is now, my e-mail inbox starts to fill up with questions like: What’s fueling the recent selling? How long will it last? Which stocks will lead going forward?

No doubt, market visibility is a bit cloudy now as Wall Street frets about a lot of things, including political gridlock as well as fragile economies in the U.S. and Europe.

I don’t know how the long the selling will last nor do I know which stocks will lead the next uptrend, but I know one thing: New leaders will start rallying before the market does, and many will break out to new highs. This is where you’ll find the true leadership.

Many growth names are still in the early stages of consolidating recent gains. Some will rally back and stage fresh breakouts; others won’t. Some stocks have corrected more sharply than others, hit hard by institutional selling in recent weeks. It will be a long road back for many of these names. A small percentage will be able to reclaim their former glory but the majority won’t.

For example, I’m not expecting big bull market winners like Apple (AAPL), Priceline (PCLN), Ross Stores (ROST) and Whole Foods Market (WFM) to provide meaningful leadership going forward. They’ve already had their day in the sun. Growth fund managers are likely to look elsewhere for new leadership.

My focus right how is on growth names that have suffered the least amount of technical damage so far — stocks whose recent pullbacks have been well contained with little in the way of institutional selling.

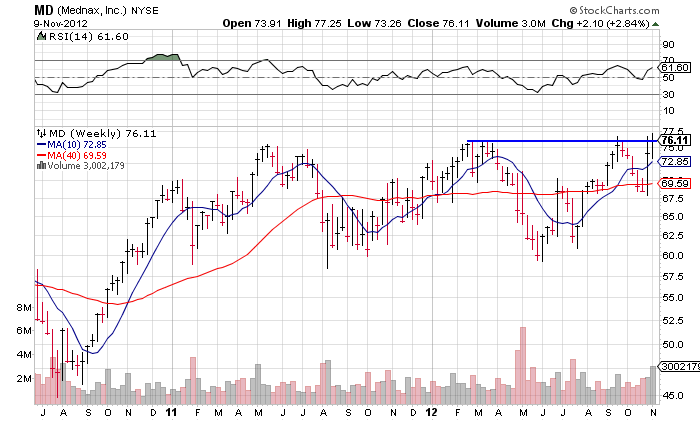

Little-known Mednax (MD) continues to show exceptional resilience an uncertain market. The company is a provider of neonatal, maternal-fetal and pediatric physician subspecialty services via hospital-based neonatal intensive care units.

It’s climbed to within 1.5% of its 52-week high, sales growth has been accelerating in recent quarters and the stock remains under accumulation. Strong fundamentals and technicals point toward a stock with leadership potential.

My watch list is pretty full right now. To see what stocks I’m watching and to view my current holdings, check out Ultimate Growth Stocks