“Quidquid id est, timeo Danaos et dona ferentes.” Laocoon

That quote has a bit of a double meaning in today’s article. Not only are the markets weary of news from Greece, but the astute trader should beware of excess bloviating from market analysts regarding macroeconomic news. (Including mine.)

Before the election, we heard how the market would keep going up if Obama was re-elected. After all, who doesn’t like continued stimulus. Well that was about 500 points ago. On the other hand, we heard that if the president was re-elected we would see a market selloff due to perceived inhospitable business environments.

Were Romney elected, we heard we would experience a market selloff (heck, I think even the Economist said this) because he would stop the unlimited stimulus programs and Bernanke would find himself out of work. On the other hand, we heard the market would come roaring back to life, employment would actually pick up (instead of just appearing to pick up because of temporary positions and people giving up looking) because of renewed faith in a more hospitable business climate.

Depending on who you listen to, this selloff is either due to even more uncertainty out of Greece, or uncertainty in the US regarding tax raises, fiscal cliffs, debt ceilings, and the boogie man. What do I think? Well, since the election, the euro is down against the dollar about 1%, and the Dow is down about 4%.

So, I think either:

1 The market is more concerned with the US economic uncertainty.

2 We are experiencing a kneejerk selloff in equities.

3 The dollar is starting to lose street cred. While euro strength is still driven by uncertainty and sovereign debt issues, US inflationary policy may begin showing itself in not just higher fuel and food prices, (you know, all that stuff that isn’t counted in calculating CPI,) but in relative strength on the global market.

Of course, I have my biases like everyone else. I also don’t hide mine and I’ve thought numbers one and three were in the works for years. But the real answer is, I don’t know. While short term economic releases move the market in the short run, longer term policies take a lot longer to show an outcome.

Therefore I try to trade off levels and if you want to make money you probably should too.

Regardless of why you “think” things are happening, things are selling off and until we have good reasons to believe otherwise, it is nor prudent to fight the short term trend.

FOREX PLAY

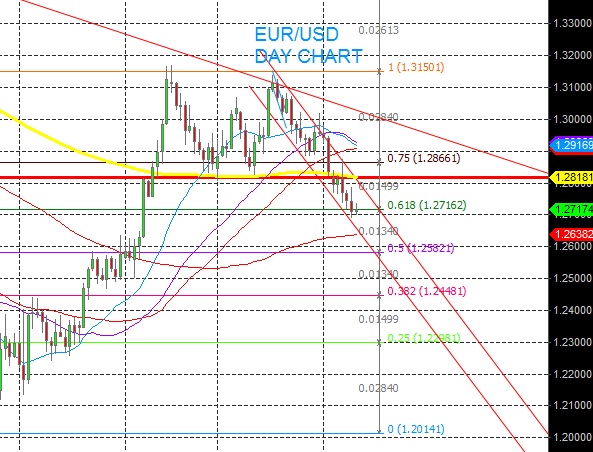

With that in mind, I would be careful selling the euro at current levels. We are on the .382 retracement of the most recent daily swing low to high. Should this level break, look out below to the .5 and .618 retracements. I am looking to short at retracements of this daily swing move lower up to the 200 day moving average , and prior resistance / support around 1.281.