Volatility declines in the FX market have made some traders reminisce the days of 200 plus pip daily moves. The lack of volatility stems from two big questions in the U.S. economy. Who will win today’s U.S. Presidential Election and will Congress be able to finally address the fiscal cliff?

Historically, elections often do not have a tremendous impact in the FX market. This election however, will probably greatly influence long term views on monetary policy for the largest economy in the world. If President Obama is reelected, quantitative easing will remain in place and easy monetary policy is expected to last for at least a couple of years, if not more. We will refrain from discussing the situation regarding Ben Bernanke, as it is possible he might not even seek another term if incumbent gets reelected. A Governor Romney upset could trigger dollar strength across the board but most noticeably against the yen.

The best trade for Election Day does not involve the U.S. dollar, but the euro and the Australian dollar. Last night, most economists (20 out of 27 Bloomberg) were stunned after the Reserve Bank of Australia did not cut rates by 25 basis points and instead kept them at 3.25%. The reaction took Aussie dollar higher against all of its major trading partners. The statement was hawkish and highlighted that recent growth in China has stabilized. It noted that inflation was slightly higher than expected and that the bank is starting to become concerned with the continued strength of its currency.

The negativity out of Europe is slowly returning and if Greece is unable to support the next austerity measures, the euro may fall under great pressure. Another catalyst for euro weakness is if Germany continues to print negative economic data (today, German Factory Orders declined the most in a year) and enters a recession.

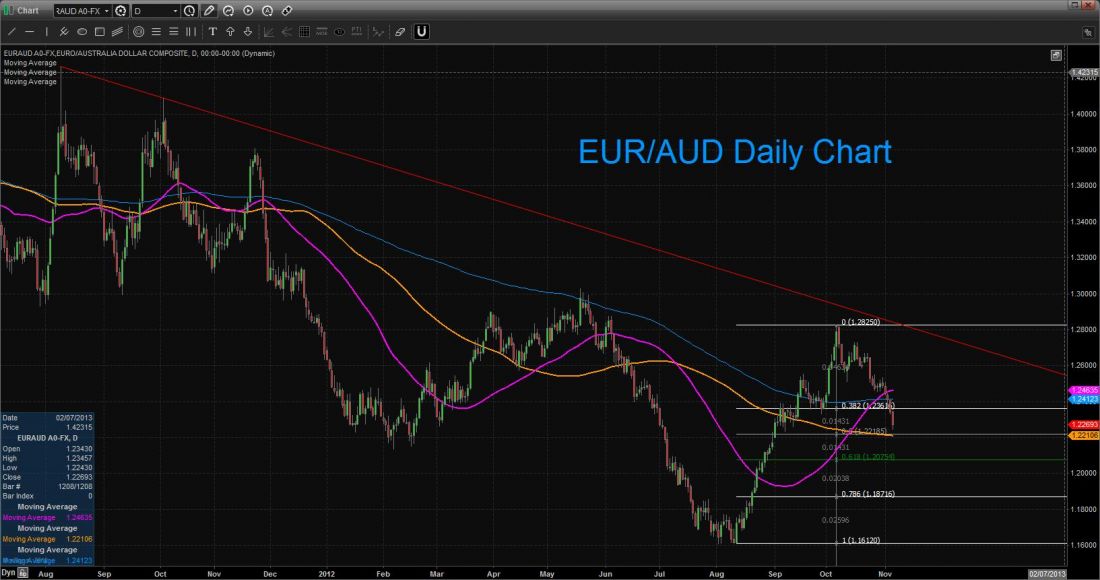

In the event, Greece’s three party coalition is somehow able to agree upon and push through the next round of austerity measures; we will only look to short he EUR/AUD if we see a test of 1.2218. Initial profit target will be the 1.1871, which is the 78.6% retracement of the July to October rally. Stops will be placed 1.2415.

= = =