[Editor’s note: Join the debate with a comment below. If you think Dow Theory still works, are you paring back stock exposure in your portfolio? Or, are you shifting to shorting strategies? Let us know your thoughts.]

The Dow Theory is the oldest and longest lived method of technical analysis surviving today. It unfolded via a series of articles written by Charles Dow between 1900 and 1902 for the Wall Street Journal and later in the book, The Stock Market Barometer, by William Peter Hamilton in 1922. In 1932 Robert Rhea formalized the principles in his book Dow Theory.

KEY COMPONENTS

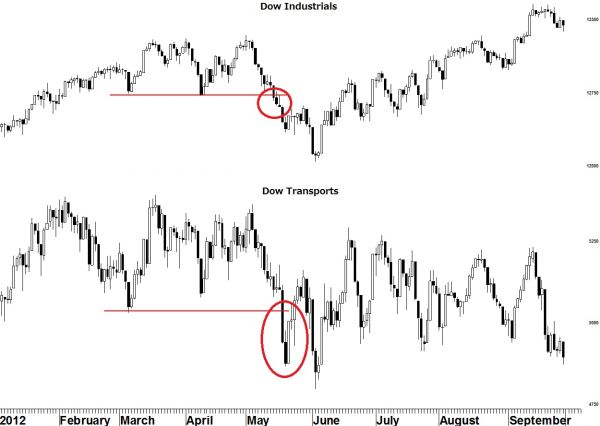

Dow Theory is composed of a handful of tenets but it is the final tenet, the averages must confirm, that technicians most often focus on today. The “averages” are the Dow Industrials and Dow Transports and they must be headed in the same direction, up or down, for an investor to be confident in the trend.

IT’S ALL ABOUT TIMING

But technical analysis is about timing and once a signal is given, the focus quickly becomes, how long of a time period typically exists between the Dow Transports making a top and the Dow Industrials.

MARKET ACTION

In May of this year, both indexes undercut their earlier, March lows. Many consider this to have been a Dow Theory sell-signal. Since that time, however, the Dow Industrials have gone on to make new highs in September. The Transports have not made new highs and until they do the sell-signal is still active.

TRANSPORT CLUES

The Transports made their high six months ago. If a bear market is coming, how long should we expect to wait until the Industrials begin that bear market? In 1998 the transports topped three months before the industrial index. In 2000 they printed their high nine months early. In 2004 the high came only one month early. In 2007 the high in the transports came three months prior to the high in the industrials.

CLOCK IS TICKING

With the Dow transportation index now six months from its high, it would seem time is running out for the bulls.

[Editor’s note: Visit Carlson’s website for a sneak peak trial subscription. ]

Looking for specific trading ideas? Read our daily Markets section here.