The market got just what it wanted Thursday when the Fed launched its third round of quantitative easing. The U.S. dollar lost ground again on the news, falling 0.6% to 79.26. Since hitting a high of 84.10 in July, the index is down 5.8%. It broke below its 200-day moving on Monday and is closing in on potential support in the 78 area.

EARLY RALLY STAGES

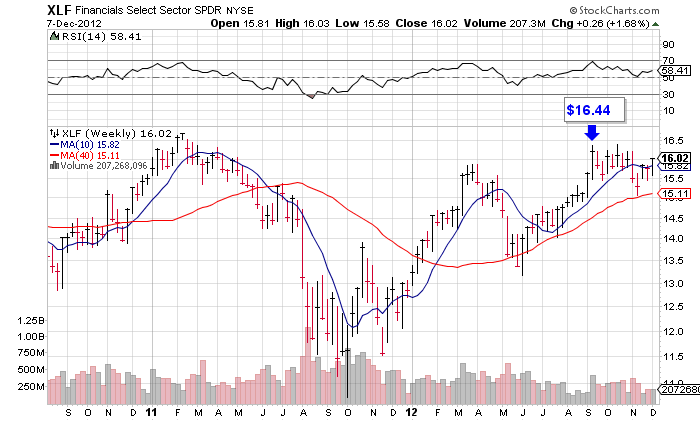

Two big beneficiaries of yesterday’s news were the SPDR Gold Trust (GLD) and the Financial Select Sector SPDR Fund (XLF). Both have been moving higher for a while. I’m not a fan of getting involved in crowded trades, but both ETFs could still be in the early stages of upside moves here.

OLD MARKET ADGE

There’s an old adage in the market: Don’t let opinions tell you what to buy. Let the market tell you what to buy. The market’s message Thursday was loud and clear: Buy gold and financial stocks.

MARKET ACTION

The SPDR Gold Trust rallied 2% Thursday to $171.31, but it hasn’t truly broken out yet. It’s still underneath a swing point (buying area) of $174. A breakout over this price level, and the fund could easily run to its all-time high of $185.85 set in September 2011. It wouldn’t be a surprising development as GLD continues to show bullish signs of accumulation.

KEY LEVELS

Meanwhile, after seven straight weekly price gains for the XLF, it broke out Thursday over $16.01. I added it to my newsletter model portfolio yesterday. Shares closed Thursday at $16.15, up 2.6% and easily within buying range. Volume totaled 138 million shares, more than triple its average daily volume of 43.6 million shares.

FOLLOW THE BIG BOYS

One could buy here and add on a pullback if it eventually comes down to its 10-week moving average just over $15. The bottom line is that big money was flowing into financials yesterday and with the market in an uptrend, it makes sense to own names being bought by mutual funds and other institutional investors.

Looking for more trading ideas? Read our daily Markets section here.