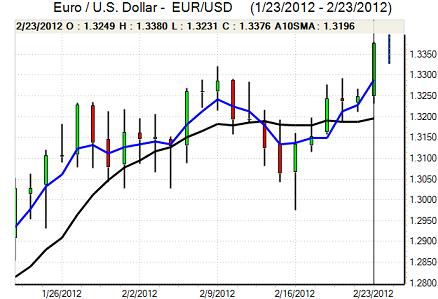

EUR/USD

The Euro held a firm tone in early European trading on Thursday as the ability to hold support close to 1.32 encouraged a further push higher. There was a further round of short covering as speculative positions were reduced and there was some triggering of stop-loss Euro buying above the 1.33 level.

The German IFO index was again stronger than expected with an increase to a eight-month high of 109.6 from 108.3 the previous month. The Institute remained confident that recession would be avoided, maintaining a more optimistic tone towards the German economy.

In contrast, the European Commission issued a generally downbeat assessment of the economic outlook, forecasting a GDP contraction for the Euro area as a whole as GDP fell in Spain and Italy. There were still underlying doubts surrounding the Greek debt deal. Immediate concerns eased slightly following suggestions that the IMF would be willing to provide additional funding, but there were very important longer-term misgivings over the underlying deal, especially with expectations that Greece would remain in a deep recession which would severely test the domestic willingness to back austerity measures.

The US labour-market data was again firm with jobless claims unchanged at 351,000 in the latest week while there was an increase in house prices according to the latest monthly report. The dollar gained some support on yield grounds while defensive demand for the currency was generally weaker with the US currency unable to secure sustained support.

The US currency did prove resilient against commodity currencies, but the Euro pushed back to highs above 1.3350 later in the US session and moved to a high in the 1.3380 area on short covering before consolidating.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar was unable to break above the 80.35 area against the yen during Thursday and dipped lower during the day with a brief test of support below 80 as movements on the crosses remained very important.

Underlying risk appetite remained firmer which curbed demand for the Japanese currency to some extent, although there was still an important element of caution, especially with unease surrounding the Chinese economic outlook.

There was strong buying on dips from funds and importers with the dollar pushing to a fresh 7-month high close to 80.50 with the Euro pushing to 107.50 which was the highest level since early November.

Sterling

Sterling hit resistance close to 1.5725 against the dollar on Thursday and briefly dipped to test support below 1.57 before recovering on wider US vulnerability.

The latest CBI industrial orders survey was stronger than expected with a 6-month high of -3 from -16 previously as fears surrounding the export sector eased slightly. There was also a stronger reading for mortgage approvals according to the latest data as buyers secured deals ahead of an ending of tax breaks.

The currency was still unsettled to some extent by Wednesday’s generally dovish Bank of England minutes while there was choppy trading conditions in the Euro/Sterling pair. Bank of England MPC member Fisher stated that he was open-minded on further quantitative easing. The UK currency dipped to 10-week lows against the Euro with a move to the 0.85 region while Sterling was only able to make slow progress to the 1.5750 area against the dollar.

Swiss franc

The dollar was unable to make any headway against the franc on Thursday and tested support close to 0.90. The Euro remained an important focus and there was a dip to lows below 1.2050.

The Swisscom business group warned that there would be no growth during 2012, but the survey was less pessimistic than in the previous report issued last year as the organisation no longer feared that demand would collapse.

The yen movements will be watched closely in the short term and further weakness could lead to increased defensive support for the Swiss currency. In this environment, the Euro dipped to lows below 1.2050 against the franc before finding some degree of support.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

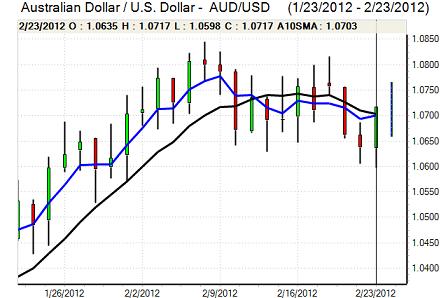

Australian dollar

The Australian dollar resisted a further test of support near 1.06 against the US dollar on Thursday and secured a generally firm tone as the US currency remained on the defensive with a peak in the 1.0750 area.

Reserve Bank Governor Stevens was more cautious on the prospect of further interest rate cuts which provided some degree of support for the currency, although the impact was offset by warnings that the currency was over-valued. The Australian dollar was also undermined by Fitch’s downgrading of three Australian banks with unease over the Chinese growth outlook also restraining buying support.