EUR/USD

The Euro initially found support below 1.3150 against the dollar on Tuesday and rallied to highs just above the 1.32 level. The German ZEW data was significantly stronger than expected at it rose to a 10-month high with the index returning to positive territory at 5.4 from -21.6 previously. The Euro was unable to sustain the gains and weakened steadily from before the US open.

There were further concerns surrounding the Greek situation with major doubts surrounding the support package agreed last week. The main opposition party indicated that it had still not signed up to the deal as protests continued in Athens. There were also major concerns from within the Eurogroup amid further speculation that there was building momentum towards letting Greece default and leave the Euro area, especially given the increasingly vocal international criticism of austerity measures as Greece recorded a 7.0% annual GDP decline for the fourth quarter. Tensions remained an important feature, especially as the planned Eurogroup meeting was downgraded to a conference call due to some elements of the Greek package still being missing.

The headline US retail sales increase was slightly below expectations at 0.4%, although the impact was offset by a stronger than expected reading for underlying sales of 0.7% which maintained general optimism surrounding the outlook. Regional Fed President Plosser stated that short-term interest rates were likely to increase before 2014, although the impact was limited given that he is not on the FOMC this year.

The Euro retreated to lows below 1.31 against the dollar before regaining ground late in the US session as Chinese central bank and government officials promising that investment into the Euro would continue. In this environment, the Euro moved back above the 1.3150 level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support close to the 78 level following the Bank of Japan meeting on Tuesday and maintained a firm tone throughout the day with a 3-month peak close to the 78.50 level.

The yen was undermined by the central bank plans for additional quantitative easing and speculation that there could also be intervention to weaken the Japanese currency to reinforce the message.

The US data did not have a major impact, but did reinforce expectations that the US economy would continue to outpace Japan. The yen maintained a weaker tone in Asia on Wednesday with demand for the currency dampened by firm gains for equity markets as the dollar held near 78.50 and the Euro also tested 3-month highs near 103.50.

Sterling

The latest UK headline consumer inflation data was in line with expectations with a drop in monthly prices pushing the headline rate down to 3.6% from 4.2% previously. There was also a decline in the core reading to 2.6% and the RPI rate dipped to below 4.0%.

The Bank of England was still forced to write a letter to the Chancellor explaining why inflation was outside the 1-3% target range and Governor King expected that the inflation rate would fall to around 2.0% by the end of 2012 which maintained expectations that quantitative easing could be expanded further if necessary.

Sterling was still unsettled by Moody’s decision to put the UK AAA rating on a negative watch which sharpened underlying fears surrounding the debt situation. There were renewed fears that stresses would eventually be alleviated through a weaker currency. Sterling dipped to two-week lows near 1.5650 against the dollar before rallying back to above 1.57 on a wider US retreat.

Swiss franc

The dollar found support on dips to the 0.9135 area against the franc on Tuesday and rallied back above the 0.92 level during the European session before retreating again

The Euro was unable to make any headway and dipped back towards the 1.2070 area. The Bank of Japan commitment to additional quantitative easing had a significant impact and there was speculation that the Swiss franc would be seen as more attractive following Japan’s move, especially if the yen remains under pressure and this could force an even more aggressive defence of the Euro minimum level.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate* 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

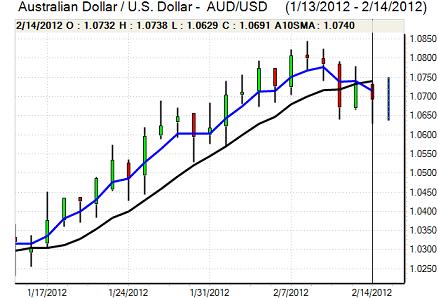

Australian dollar

The Australian dollar was unable to hold above 1.07 against the US currency on Tuesday and retreated to test support below 1.0650 before finding fresh buying support as risk appetite attempted to stabilise and equity markets pared losses.

Domestically, a rise in consumer confidence had some positive impact on the currency even though international considerations were dominant. Gains for regional equity markets and a generally weaker yen helped push the Australian dollar back to the 1.0750 area as markets tested recent ranges.