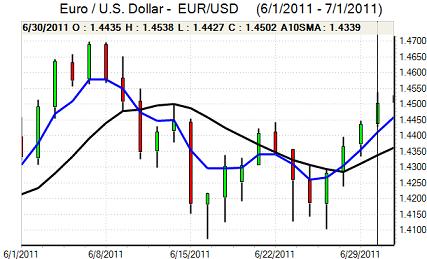

EUR/USD

The Euro found support on dips to the 1.45 area in European trading on Monday and rallied to the 1.4550 area as narrow ranges prevailed. Trading was inevitably subdued with US markets closed for the Independence day holiday.

There were further doubts surrounding the Euro-zone situation with persistent speculation that any plan to restructure private-sector debt could put Greece into selective default. There was also some speculation that such a default could be limited and temporary which could lessen risks surrounding any bond restructuring. In this context, comments from the ECB will be extremely important for sentiment following Thursday’s council meeting.

The German constitutional court will also start its hearings into the legality of German contributions to a Greek rescue fund on Tuesday which will add to the mood of uncertainty.

The Euro-zone economic data provided some degree of relief with a rise in the Sentix index for the month, although this was over-shadowed by underlying fears surrounding the sovereign-debt outlook and European financial sector.

The US debt negotiations will continue to be watched closely in the short term with the US needing an agreement this month to prevent massive disruption and a possible debt default.

Risk appetite was generally weaker during Asian trading on Tuesday which triggered a renewed decline in the Euro to below 1.45 with the currency also unsettled by underlying demand for Euro puts and a squeeze on short dollar positions with some reports of large funds buying the US currency.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

Yen

The dollar found support on dips to the 80.55 area against the yen during Monday and consolidated in the 80.80 area with some residual support from a rise in longer-term US Treasury yields. There were some net flows into overseas investment funds from Japanese investors which also undermined the yen.

There were further uncertainties surrounding the Chinese economy in Asian trading on Tuesday with speculation that there could be a further increase in interest rates while there was also unease over the banking sector’s exposure to rising bad loans in the local government sector. The yen failed to gain any significant support and pushed to a high just above 81 during the Tokyo session.

Sterling

Sterling was unable to hold above 1.61 against the dollar during Monday and generally consolidated in a 1.6065-1.6095 ranges in subdued trading with the Euro finding support on dips to the 0.90 area with Sterling finding it difficult to gain any safe-haven support from Euro-zone doubts.

The construction PMI index edged weaker to 53.6 for June from 54.0 previously which did not have a major impact. The services-sector data later on Tuesday will be much more important for Sterling as it could have a pivotal impact on economic sentiment. A weak reading would reinforce expectations of extremely low interest rates over the next few months while any improvement in the index would provide significant near-term relief for Sterling confidence.

There was further speculation that Sterling could be used as a global funding currency and this tended to keep the currency under pressure with a dip to test support just below 1.6050 in Asia on Tuesday.

Swiss franc

The dollar continued to probe resistance above the 0.85 level against the franc during the past 24 hours, but has been unable to sustain a break above this level. Similarly, the Euro pushed to a five-week high close to 1.2350 against the Swiss currency before retreating back towards 1.2280.

There were fresh doubts surrounding the Greek situation which dampened confidence in the Euro-zone and helped lessen selling pressure on the franc. There was a general lack of confidence in the other major currencies which continued to protect the franc from aggressive selling and the currency also gained some support from a more fragile attitude towards risk in Asia on Tuesday.

Source: VantagePoint Intermarket Analysis Software

Call now and you will be provided with FREE recent forecasts

that are up to 86% accurate * 800-732-5407

If you would rather have the recent forecasts sent to you, please go here

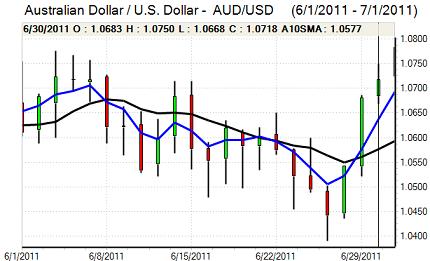

Australian dollar

The Australian dollar was trapped just below the 1.0750 area against the US dollar on Monday with no real attack on support levels as trading volumes declined.

The was more significant downward pressure ahead of the Reserve Bank interest rate decision on Tuesday with a retreat towards 1.0680. A higher than expected trade surplus failed to provide support as there was also a more cautious attitude towards global risk appetite.

As expected, the central bank held interest rates at 4.75% with the bank stating that a mildly restrictive policy was still appropriate. The bank was more cautious over the economic outlook which pushed the Australian dollar slightly weaker following the decision.