Russia has offered no shortage of headlines in 2015, and events don’t suggest any reversal to this trend in the near-term.

Indeed, the stability the entire Russian economy is being called into question with the possibility of $30/barrel crude looming on the horizon

Many, Goldman Sachs and myself included, are calling for mild winter in 2016 that only serve to exacerbate the oversupply of the commodity…

Russia has declined to send delegates to Friday’s OPEC Meeting, with pressure mounting on Saudi Arabia to cut its production to help crude find what can only be a near-term bottom.

Such a scenario appears unlikely, as King Salman doesn’t want to be perceived as giving ground to OPEC. More importantly, regional rival Iran is ramping up output as sanctions are being lifted.

Russia’s been able to mitigate the effects of this steep decline through currency devaluation and a reduction in spending, but are left with little means at their disposal if crude drops past $30…

Crude is going to $0, I’m certain of it. Just like the Internet wasn’t a fad, although this comes with perhaps with a bit longer of a timeframe.

As a side note, the US is now the world’s largest oil producing nation – surpassing Saudi Arabia by over 2 million barrels a day.

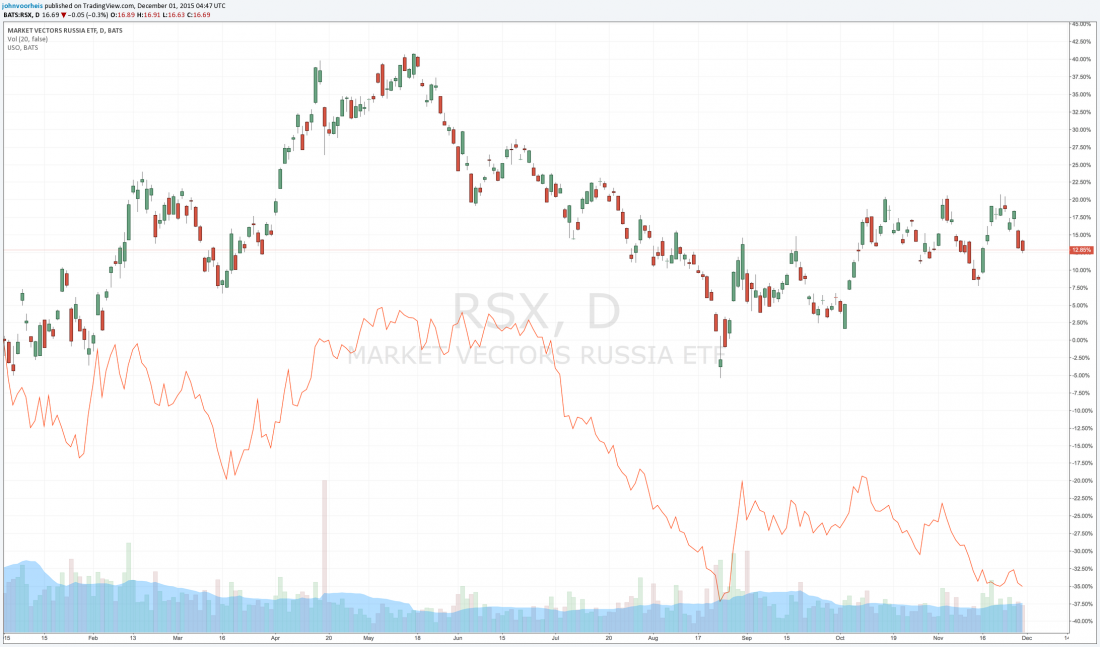

Over a third of The Market Vectors Russia ETF (RSX, 16.69) holdings are in the energy sector, with significant exposure to Materials and FinServ (some of the first to be affected in the event of an all-out economic collapse).

RSX is up 14 percent YTD, and has traded in a 52-week range of 12.50-20.84, having clocked it’s 52-week high on May 15.

United States Oil (USO, 12.93) is down 36.5 percent YTD, having traded in a 52-week range of 12.37-26.08. Shares hit their 2015 high (21.50) on May 6.

With RSX following the price action in USO, I like this ETF as a means to play my bearish outlook on crude.

Friday’s OPEC meeting can only create more selling pressure in USO, but such movement is priced in to RSX to a lesser degree.

Putin’s incessant saber rattling is also inherently bad for business, granting further credence to my bear mindset.

The RSX Feb16 17 Straddle is $2.15 – implying a nearly 13 percent move by February expiration.

My Trade: Sell the RSX Feb 15-17 Bear Call Spread for $1.24

Risk: $76 Per 1 Lot

Reward: $124 Per 1 Lot

Break-even (share price at expiration): $16.24

To learn more about equity and ETF option trading, join AlphaShark Trading’s Weekly Workshop Series by Clicking Here

http://alphashark.com/traderplanet-jv