The stock indices are bouncing from key areas that could support a swing low in the market near-term.

The ES, NQ, YM and TF have all reached key levels of support simultaneously. This is typically good for at least a bounce. If there is no bounce and these levels are breached in earnest, this would be a significantly bearish development for stocks. This is the spot where the bulls have the best chance of turning things around.

Given the context of the area just tested, calling for a bounce is logical, as we will outline next. If we continue higher and get above near-term resistance, last week’s low will look like the other swing lows that the market has made over the last 18 months and in a very logical spot.

The flip side of this is that a breach of last week’s low across all these indices would be a very significant bearish signal and something that we would take very seriously as a sign of substantial downside danger.

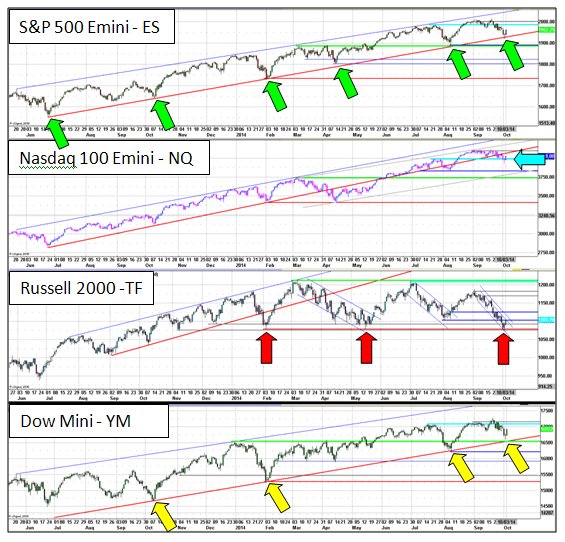

At this zoomed out distance (May 2013 – present), you can see a number of notable things that came into play at last week’s low, contributing to its importance:

A. The ES was testing trend line support that has held on 4 previous tests (green arrows)

B. The NQ was retesting the breakout level as defined by the July high (blue arrow)

C. The TF was testing the lows of the year (red arrows)

D. The Dow was testing trend line support (yellow arrows) and retesting the Q1 2014 highs

We feel the most important bullish development from this point would be for the Russell (TF) to break above what is a descending trend channel. If this were to occur, we feel this would support a move higher in the indices across the board.

We feel the most important potentially bearish development would be a break by the Russell (TF) to new lows for the year and for the other indices to break their recent levels of support. In a transition to a bear market, we feel the Russell would lead the way and be a signal of impending across the board losses.