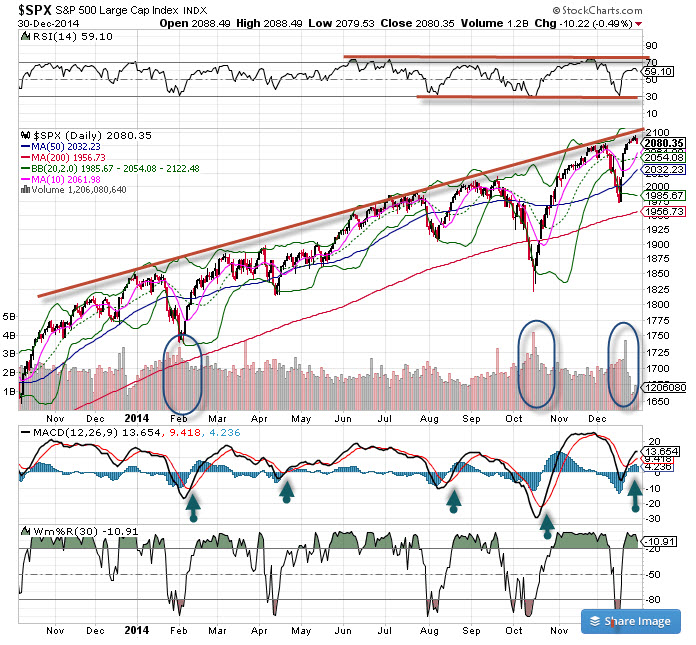

Last week, we talked about a bit about fixed income in the New Year and how I prepare for my investment thesis, which is my expectation around the Fed. With the strong accommodation continuing, even if they decide to raise rates (to normalize policy), the equity markets are still going to be the place to be. The early figures for 2014 appear to be the SPX is up double digits for the second straight year.

So, as we prepare for the coming year, we can pretty much count on certain themes to carry the weight.

If the market is going to see more upside in 2015 we would like to see the financials continue to participate. The financials were one of the better performing groups last year, as they rose sharply with little fanfare. Stocks like WFC, GS, MS, BAC, JPM and others are considered boring, but the banking group XLF was up about 20% this year. I’ll take that kind of boring any day.

Energy is going to be a focal point as we saw oil come crashing down into bear market territory over the past few months. Some of the biggest and most levered names were smashed in the fourth quarter, but if crude comes back, these names might be worth a look.

Technology, Internet, media and consumer products are always some of biggest leaders. 2014 was a big year for IPOs in these groups along with M&A. That could continue if sentiment and money flows remain robust. Some of the names I’ll be looking at include FB, TWTR, DIS, AAPL, GPRO, BABA, AMZN, KO, GMCR, MSFT and NFLX.

We are still in unprecedented times, with extraordinary support from the Fed for our economy and markets. However, there is very little left to be done to get more growth. Hopefully, the results in 2014 will spill over to 2015 and give us all a good reason to stay long the markets.

#####

To learn more about Bob Lang’s products and services, click here.