After experiencing the “new member” process, just about every Social Networking “fraternity pledge” has had to worry about what lies ahead at the initiation ceremony. Facebook (FB) was certainly no stranger to this process, and now it is another darling joining in – Twitter (TWTR).

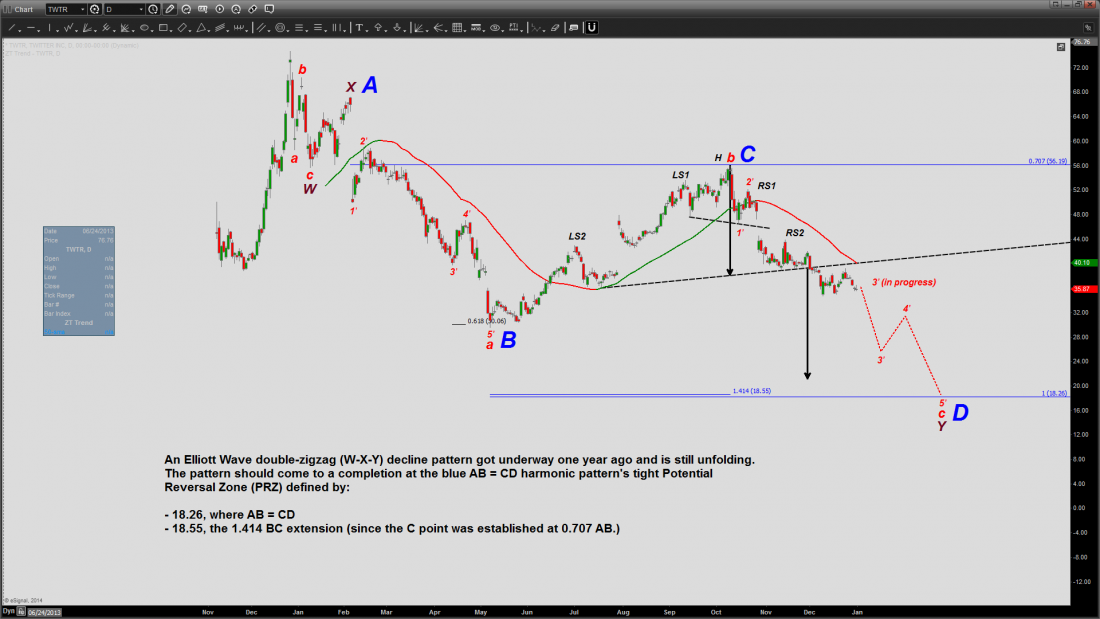

In the chart below, TWTR’s fall from grace is shown to have started in late December 2013 on the heels of a successful IPO that set a “top speed” of $74.73 on December 26th. However, the wrath of the ensuing five months took a 60 percent toll on the stock price before the bulls, emboldened by strong earnings results, would wage a counter attack at some of the bears’ strongholds.

As depicted in the chart below, the wave structure is clearly a far cry from a “random walk”. The initial zigzag, wave W, gave way to a short-lived bounce that would set the stage for wave a of Y, the first leg of the second zigzag, that wouldn’t relent until breaking the $30 support barrier. What would then ensue is the audacious move mentioned earlier, which reclaimed 70.7% of wave a of Y. In the world of harmonic trading, the 70.7% (or 0.707) ratio is well known and derived not from the Fibonacci numbers sequence, but rather Pythagoras’s constant, the square root of 2. (i.e., 0.707 = 1/SQRT[2]).

In blue, I have outlined the four points defining the harmonic AB = CD pattern, namely, A, B, C, and D. The CD leg is equivalent to wave c of Y in Elliott Wave parlance, and hence should bring the Elliott Wave “double zigzag” decline pattern to a successful completion. In order to compute the ideal landing zone for wave c of Y, I rely on the AB = CD harmonic pattern properties, looking for the 1.414 BC extension to closely align with AB = CD.

In other words, we’re looking for the pattern to come to a conclusion in a tight area (i.e., Potential Reversal Zone or PRZ) defined by the AB = CD relationship and the 1.414 BC extension. Unsurprisingly, the two measurements are within a couple of dimes of each other, as depicted in the chart. With TWTR currently trading near $36, it’s almost inconceivable that the stock would be subjected to yet another 50 percent haircut. However, we all know to expect the unexpected in the stock market.

Finally, it would normally serve us well to glance at the options Open Interest figures for the coming months, looking to get a read on the smart players’ chip placements (i.e., option strikes with high open interest). As of this writing, the data is inconclusive, as the bets appear to be all over the place. However, the picture will likely get clearer the closer we near earnings release time, and I’ll certainly follow up with another article ahead of the big day.

#####

For more information on this, please click here.