Last week we had a good discussion on a few charts (link). I thought it would be nice to see what our volume and price analysis yielded and where one might proceed given current charts.

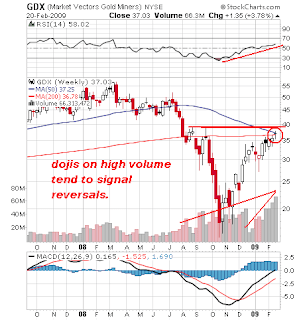

GDX held its own with quite a bit of strength. As I said last week, it will have trouble breaking above 37 because that is the price level where the 50 and 200 are crossing in a bearish manner. Although gold may be showing strength, or at least verbal strength among the media (we are headed towards an apocalypse, no?), gold mining companies are not the same thing and don’t react the same way. With the high volume giving a, what looks like, perfect doji on the weekly, I’d be surprised if this didn’t pull back during the next week. It’s a possibility, but odds point towards some downwards movement. |

Last week I said, “RIMM is flirting with its 50 day moving average” and that a “break below the 50 is not a good sign” for the longs. Looks like RIMM took the flirting to the next level. I drew some possible support lines. I think it’s good that the volume is picking up again, but I wouldn’t consider going long until there was some serious buying. Not sure if that will happen. An interesting stock to day trade. |

On the huge downward movement last week, I was worried that COH might break. It held up nicely, though–just as many predicted would happen last week (check the comments). Even with the strength I’d watch for the downward movement of the MAs and make sure the bottom in the RSI doesn’t break. On the huge downward movement last week, I was worried that COH might break. It held up nicely, though–just as many predicted would happen last week (check the comments). Even with the strength I’d watch for the downward movement of the MAs and make sure the bottom in the RSI doesn’t break. |

Here’s a perfect example of how a point and figure chart should be used (and how it can help “support” an interpretation of a candlestick chart, or vice versa). I drew a support line across the bottom, right above $13 or so. You want to watch levels like this (especially when you have three definitely rows using it as support) because the level often leads to a breakdown or a intermediate bottom. You can also use it as an excellent entry position. For example, you could purchase a share at a recent low (somewhere above $13) and place your stop below support. This creates a nice low risk entry point. |

As always, take responsibility for your own trades, and take care of yourself.