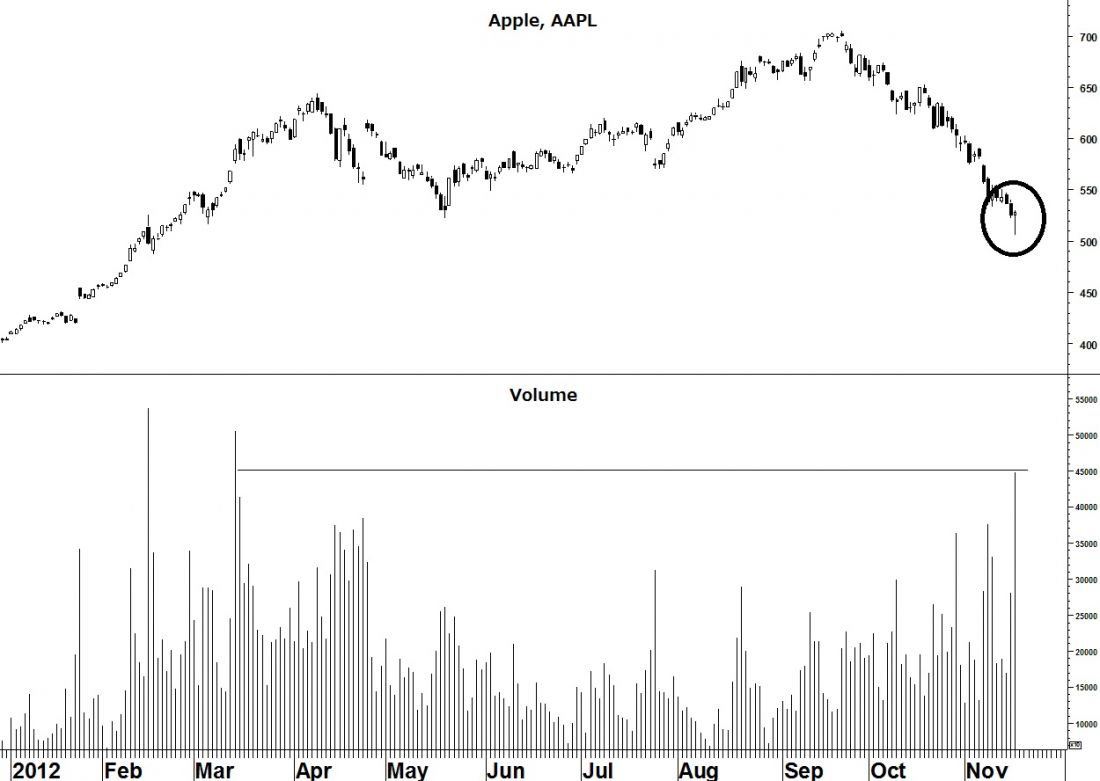

On Friday, Apple printed a hammer candlestick on the biggest volume it has seen since last March. This is a classic reversal signal and just in time.

This week, on Thursday, is the US Thanksgiving holiday. Equities usually rally into holiday-shortened weeks and the tendency to rally is even greater when that holiday is Thanksgiving or Independence Day (July 4). But how long will the rally last?

RALLY DOOMED TO FAIL

Unfortunately, for bulls, the message we get from a middle section count (George Lindsay) is that the rally is doomed to fail and more downside lies ahead almost immediately after this Thursday’s holiday.

A middle section is that time in a bull market when the rate of ascent, or slope, is less than what came before or after the middle section. The pattern begins at point B and extends to point H. Counts are taken from either point E or point C. Point C is the day of the break down from the minor top formation of which point B is the high. Counting from point C on 12/13/11 to the low on 6/4/12 is 174 calendar days. Counting forward an equidistance targets a high on Sunday, 11/25/12.

MARKET HIGH SEEN

It seems highly likely that a market high will be seen on, or very near, next Monday, 11/26/12.

Here comes the Turkey!

= = =